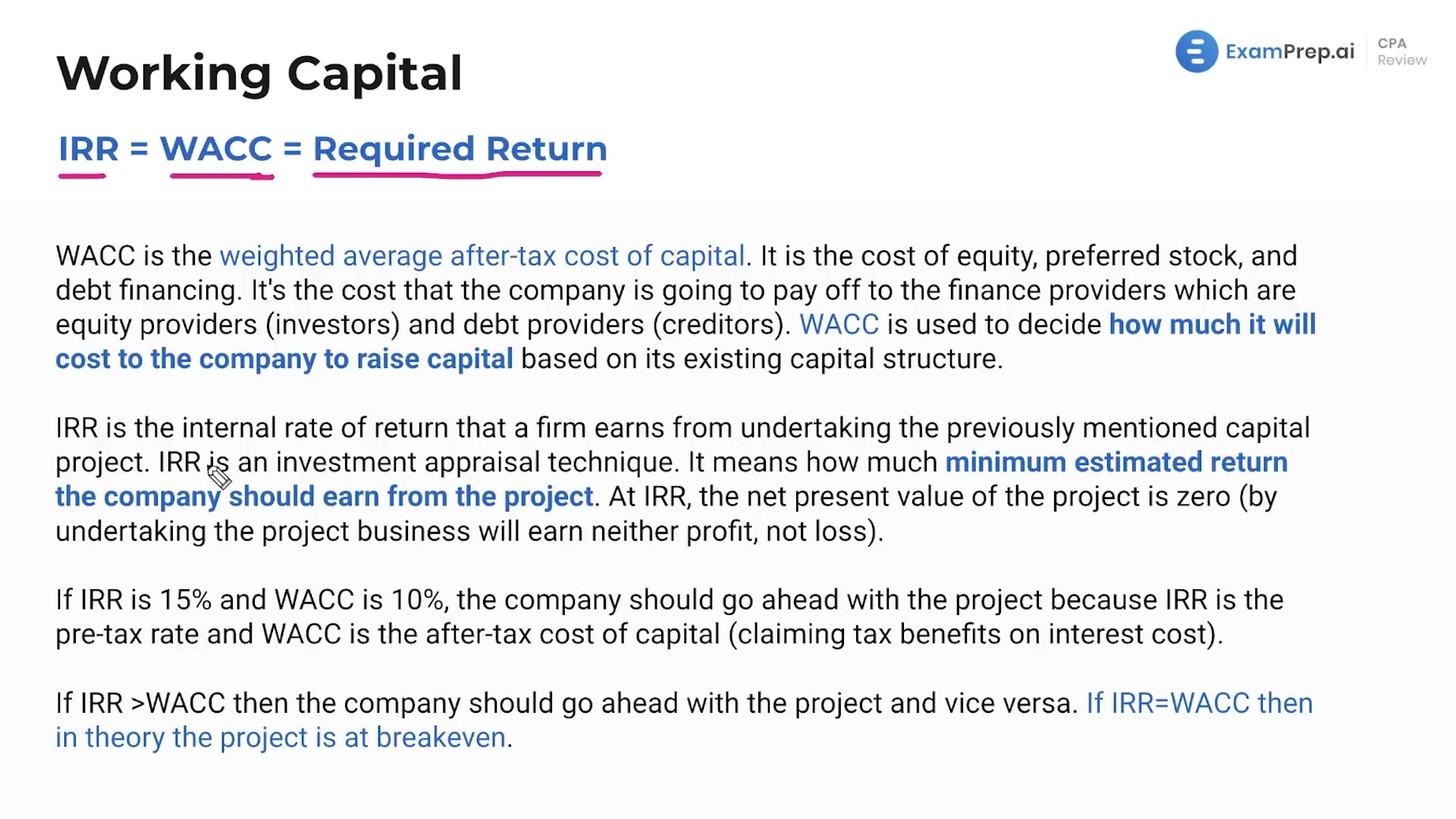

In this lesson, Nick Palazzolo, CPA, takes a deep dive into the Internal Rate of Return (IRR) and its relationship to the required return as part of the capital budgeting process. He elaborates on the concept of the Weighted Average Cost of Capital (WACC), discussing its role as a benchmark for evaluating the cost-effectiveness of capital projects based on a company's existing capital structure. Nick simplifies these terms and illustrates their relevance by equating WACC with the minimum return necessary for a project to break even, which is also the IRR. With vivid examples, he clarifies that a project is worth pursuing if its IRR exceeds the WACC, considering both the pre-tax and post-tax implications. By the end of the lesson, the break-even analysis is demystified, making the theoretical aspects of IRR tangible and applicable for real-world financial decision-making.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free