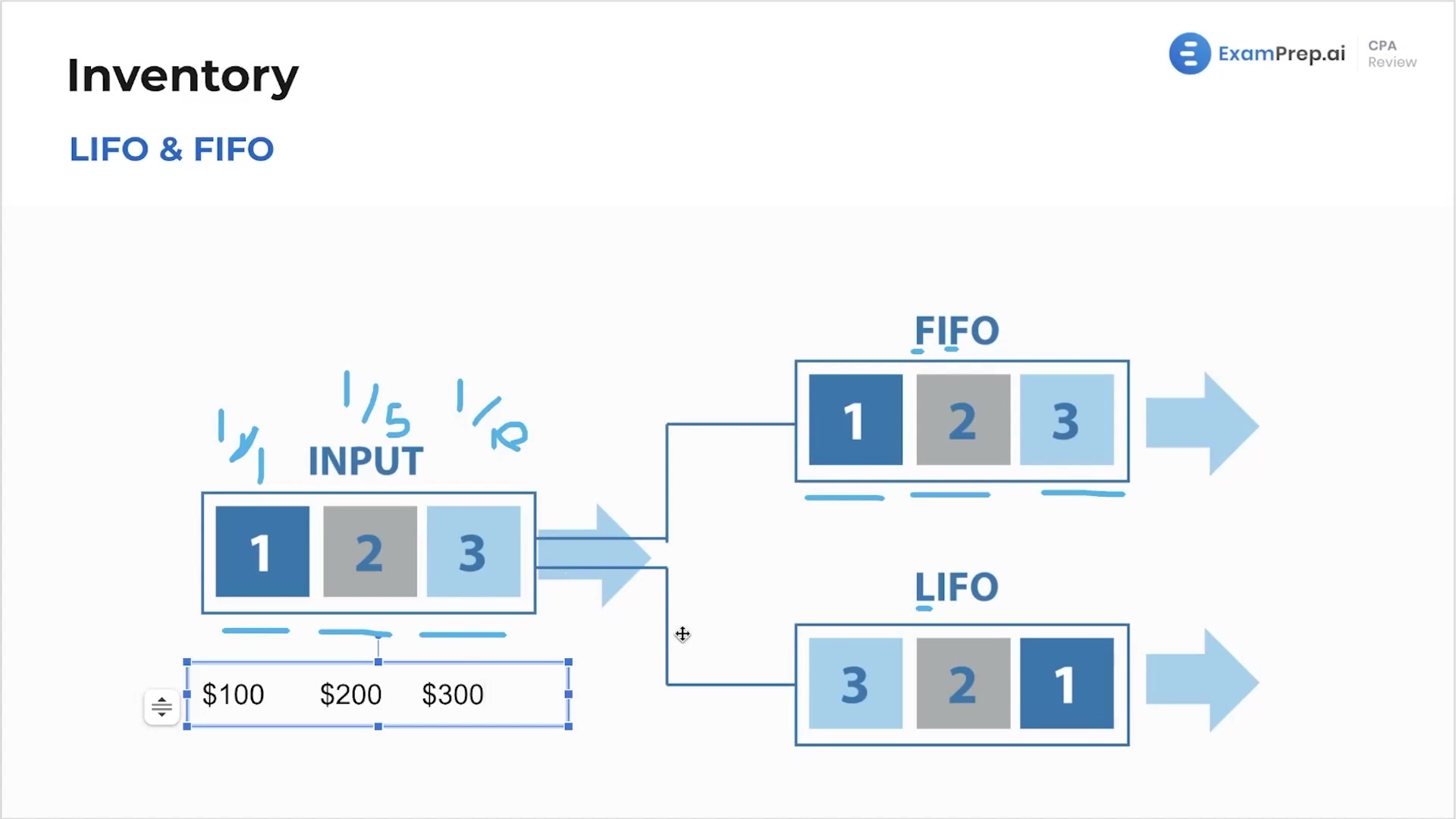

In this lesson, Nick Palazzolo, CPA, breaks down the inventory valuation methods of LIFO (Last In, First Out) and FIFO (First In, First Out), crucial concepts for accounting inventory costs and their impact on financial statements. He builds a simple analogy using televisions at Best Buy to illustrate how each method affects cost of goods sold and net income, especially during periods of price fluctuations. With engaging examples and clear calculations, Nick makes it easy to grasp how choosing different inventory accounting methods can lead to vastly different financial outcomes. Dive into this foundational topic to understand how inventory management influences a company's financial health and to prepare for related exam questions.

This video and the rest on this topic are available with any paid plan.

See Pricing