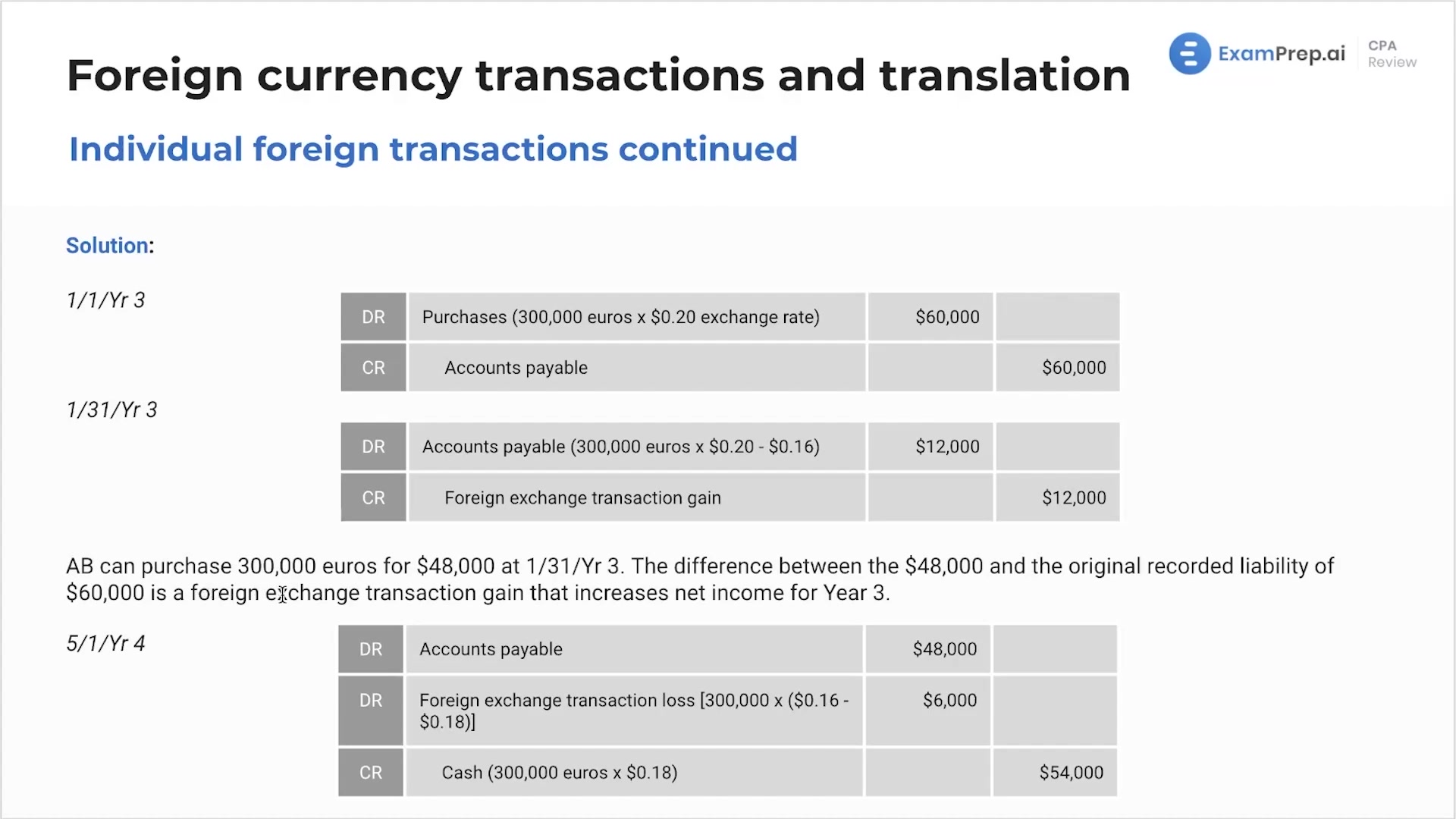

In this lesson, Nick Palazzolo, CPA, breaks down the intricacies of journal entries related to foreign currency transactions, offering a clear explanation on valuation of assets and liabilities. He begins by introducing the concepts of various exchange rates—historical, spot, and current—and demonstrates how these are implemented when purchasing goods on credit in a foreign currency. Nick emphasizes the importance of understanding which exchange rate to apply and how this decision impacts the recording of foreign transaction gains and losses. He walks through the process of recording these transactions over time, showing how exchange rate fluctuations lead to gains and losses that affect net income. Nick also provides practical advice on preparing for these types of journal entries, and highlights the significant difference between currency translation and remeasurement, ensuring a thorough grasp of this critical topic.

This video and the rest on this topic are available with any paid plan.

See Pricing