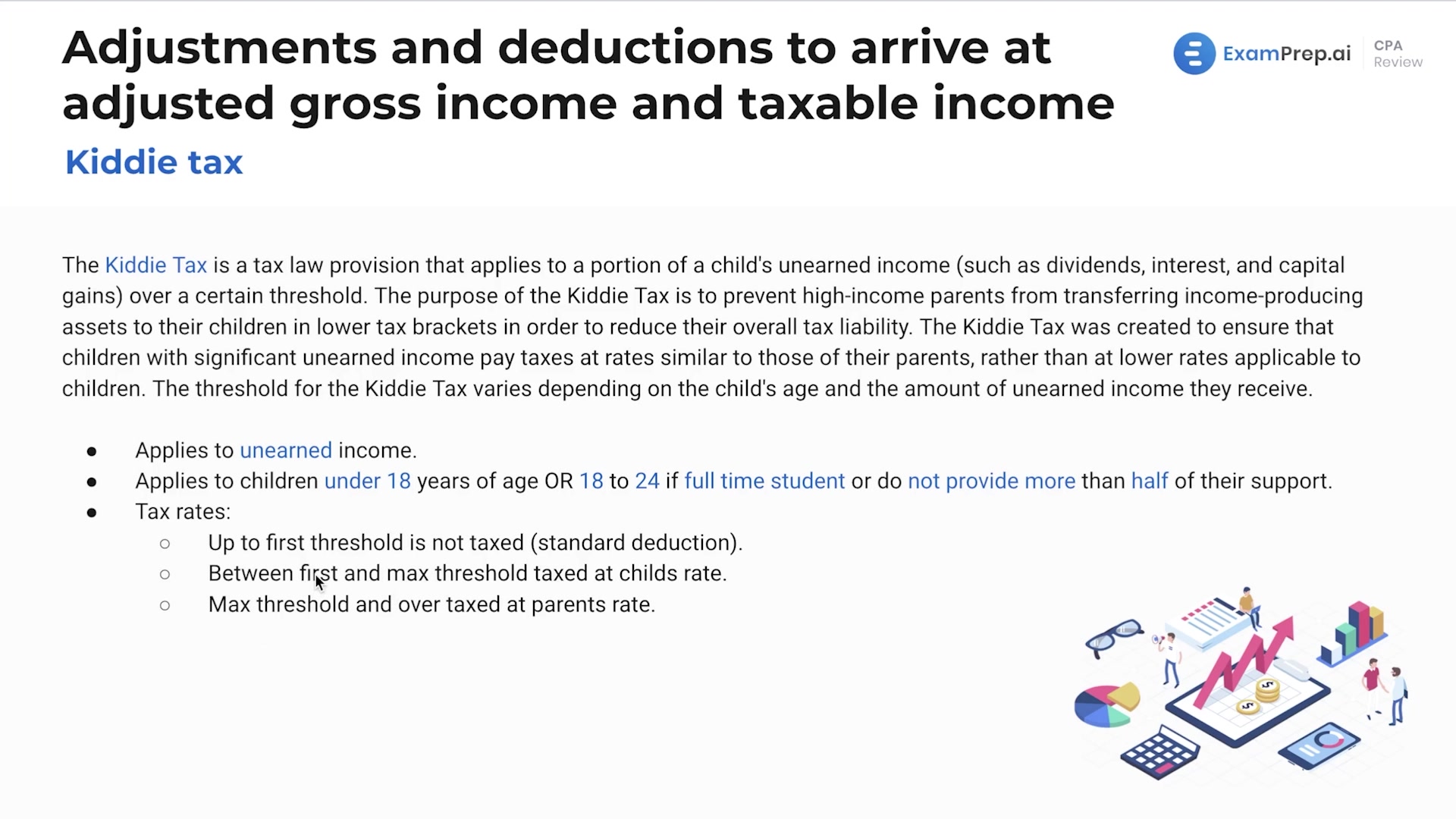

In this lesson, Nick Palazzolo, CPA, demystifies the kiddie tax, a regulation designed to prevent parents from shifting their unearned income to their children to take advantage of lower tax rates. He provides a detailed explanation of how the kiddie tax applies to a child's unearned income, such as dividends, interest, and capital gains, underscoring the pivotal income thresholds to watch for. The lesson clarifies which children the tax impacts, the varying rates based on the child's unearned income, and how the tax aligns with parents' marginal tax rates. To solidify understanding, Nick walks through an illustrative example demonstrating the calculation of the kiddie tax and how it integrates with a parent's tax return, offering clear insights into this nuanced tax policy.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free