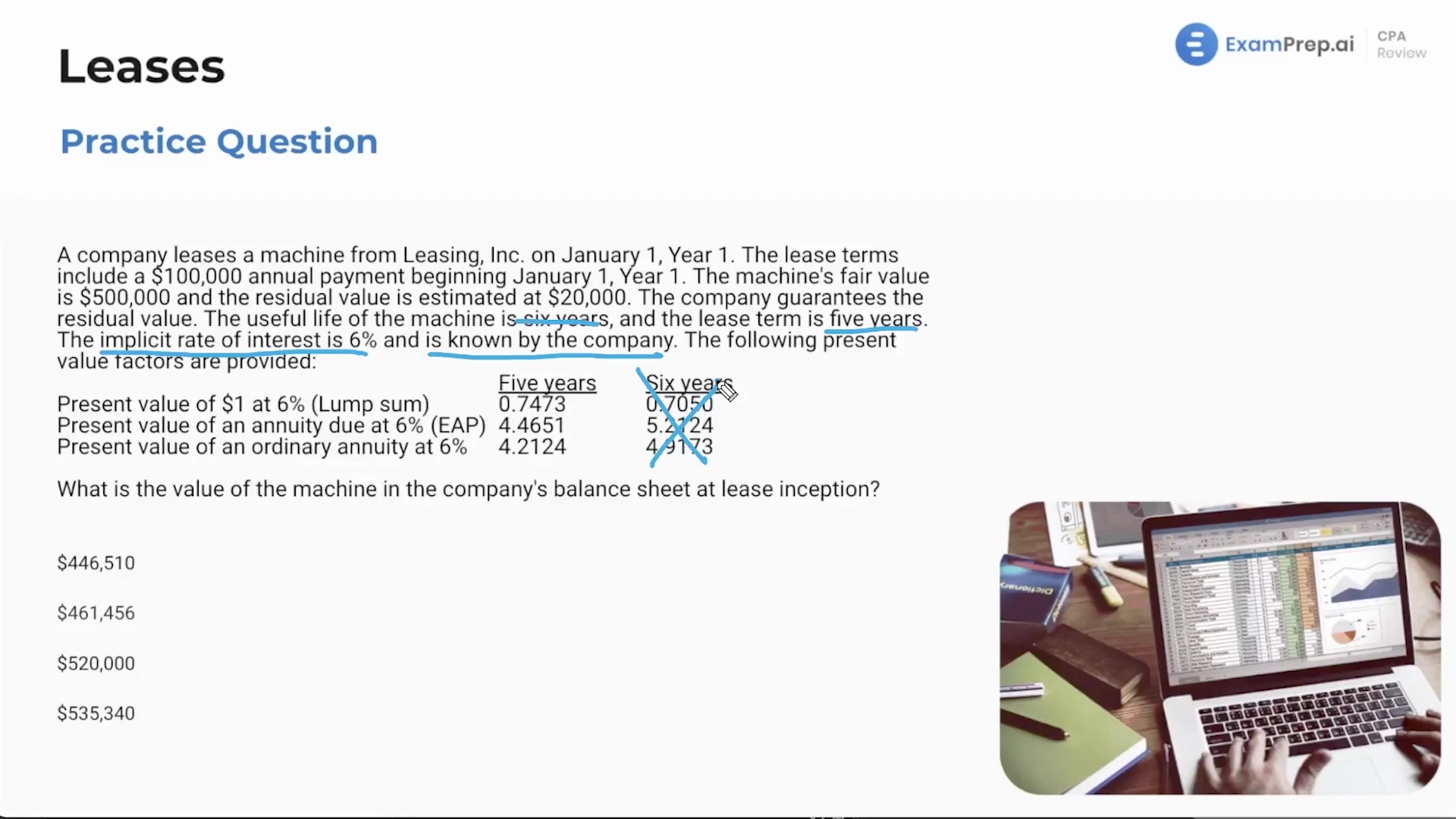

In this lesson, Nick Palazzolo, CPA, dives into the intricacies of lease accounting with a set of practice questions aimed at clarifying when to begin recognizing rental expenses and how to determine the value of leased equipment on a balance sheet. Through walking you through the thought process of handling operating lease scenarios and the placement of leased assets into service, Nick ensures clarity on accrual versus cash basis accounting. He then tackles a calculation-intensive example, methodically breaking down the factors that affect the present value of lease payments and residual values. Nick's approach demystifies complex lease accounting concepts, giving you practical tools to apply in real-world CPA exam questions, alongside the confidence to parse through the factors and costs involved.

This video and the rest on this topic are available with any paid plan.

See Pricing