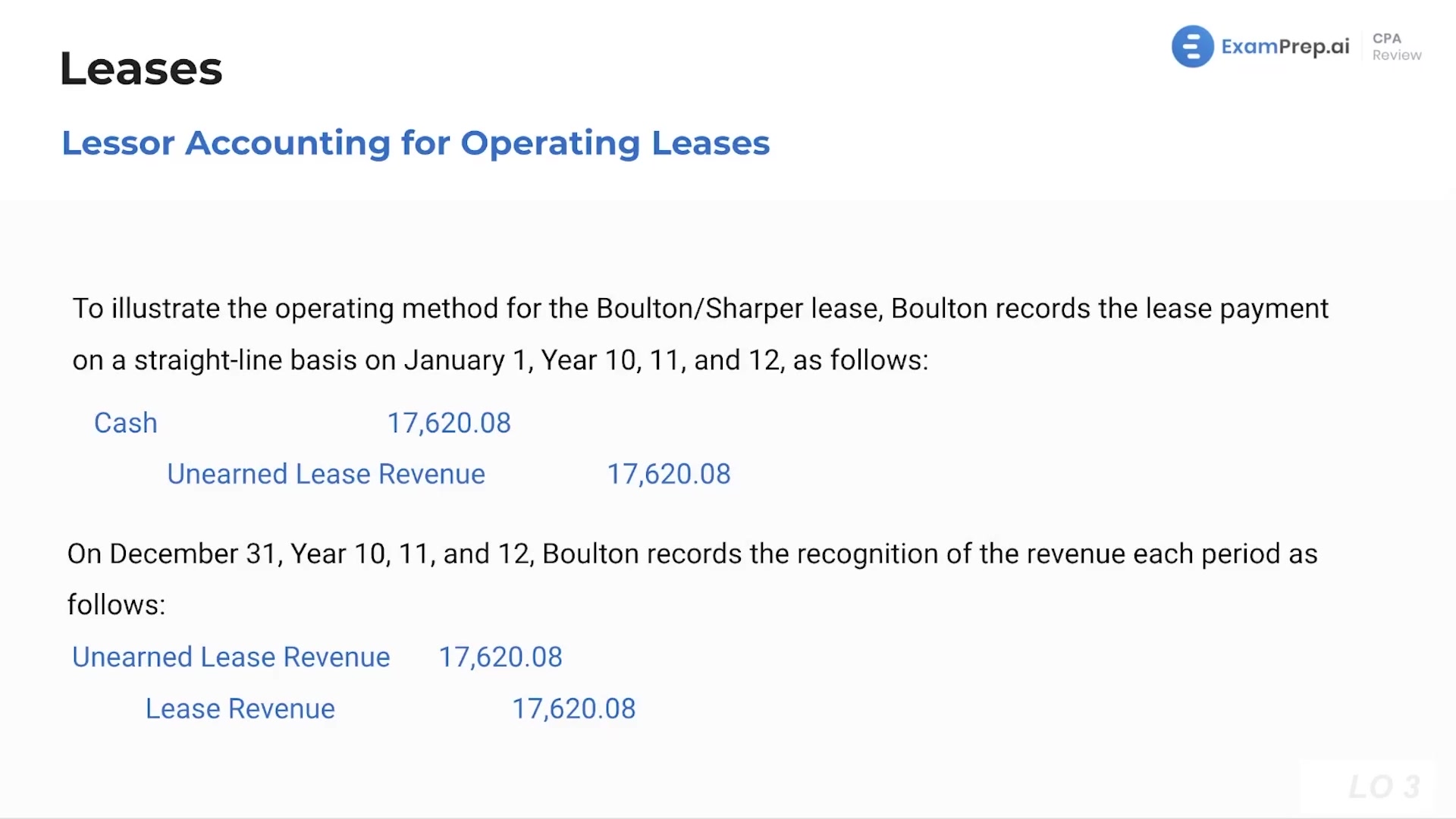

In this lesson, dive into the mechanics of how operating leases are accounted for from the perspective of the lessor, the party leasing out the asset. Nick Palazzolo, CPA, begins with a concise recap on financing leases before differentiating between the treatments of finance and operating leases. He intricately explains the criteria for an operating lease and outlines the accounting procedures a lessor must follow when this classification is determined. You'll learn about the implications of asset ownership on balance sheets, how revenue is recognized over time, and see real journal entry examples illustrating the depreciation of leased assets and the recording of other lease-related costs like insurance and maintenance. Accompany Nick as he breaks down the application of the double declining balance method and other key aspects of lessor accounting in a way that's simple to grasp and relevant for practical use.

This video and the rest on this topic are available with any paid plan.

See Pricing