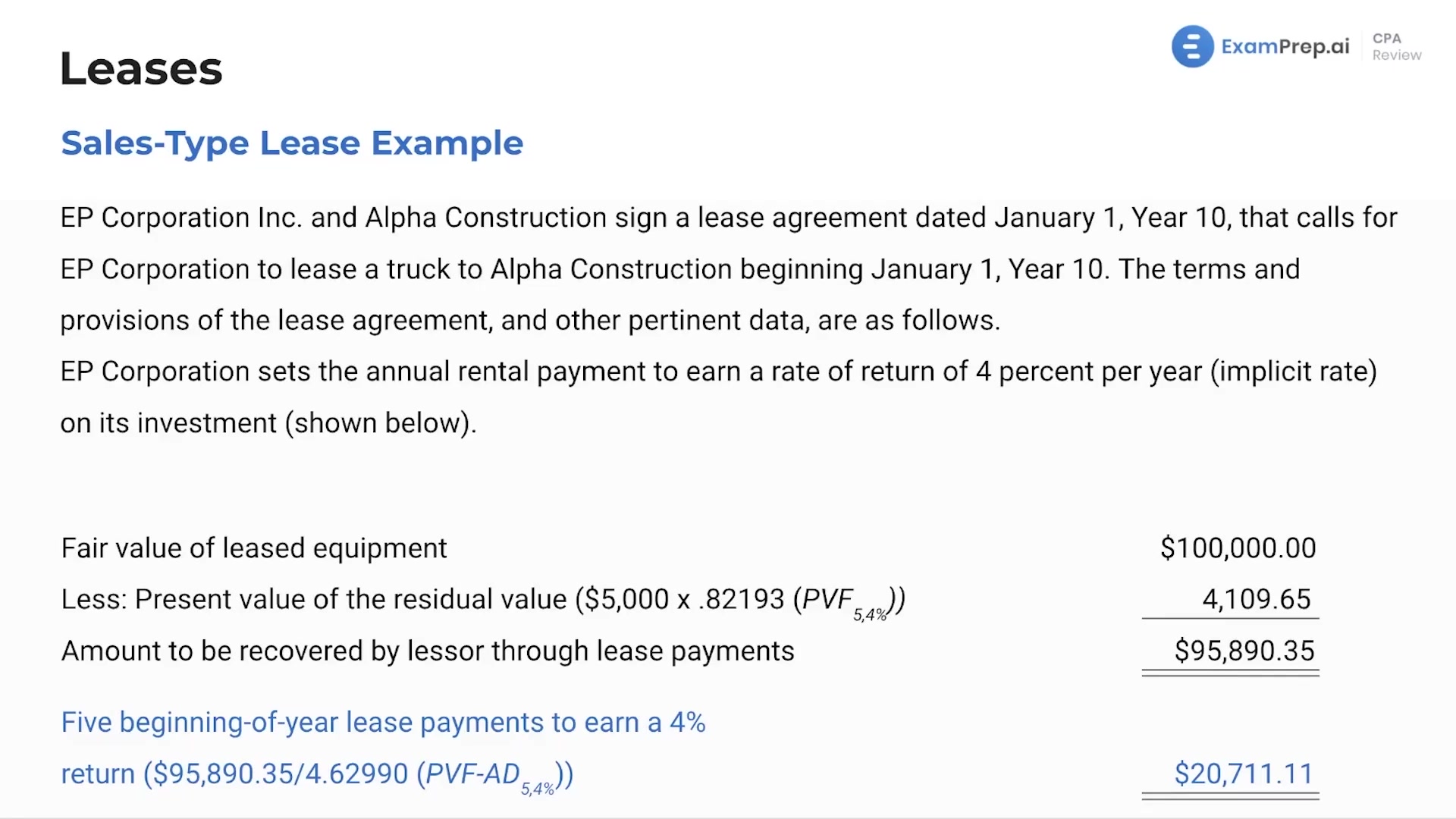

In this lesson, Nick Palazzolo, CPA, breaks down the complexities of lessor accounting for sales-type leases. He thoroughly examines the criteria and tests used by lessors to classify leases as either sales-type or direct financing, detailing how to differentiate between the two. Focusing primarily on the sales-type lease, Nick walks through the process of recognizing a lease as a sale, including the calculation of lease receivable and presentation of sales revenue on the financial statements. He explains the accounting measurements and even runs through example journal entries, ensuring a practical understanding of how to record lease payments and interest revenue over the term of the lease. This provides a clear-cut guide on how lessors should approach and account for sales-type leases in their financial records.

This video and the rest on this topic are available with any paid plan.

See Pricing