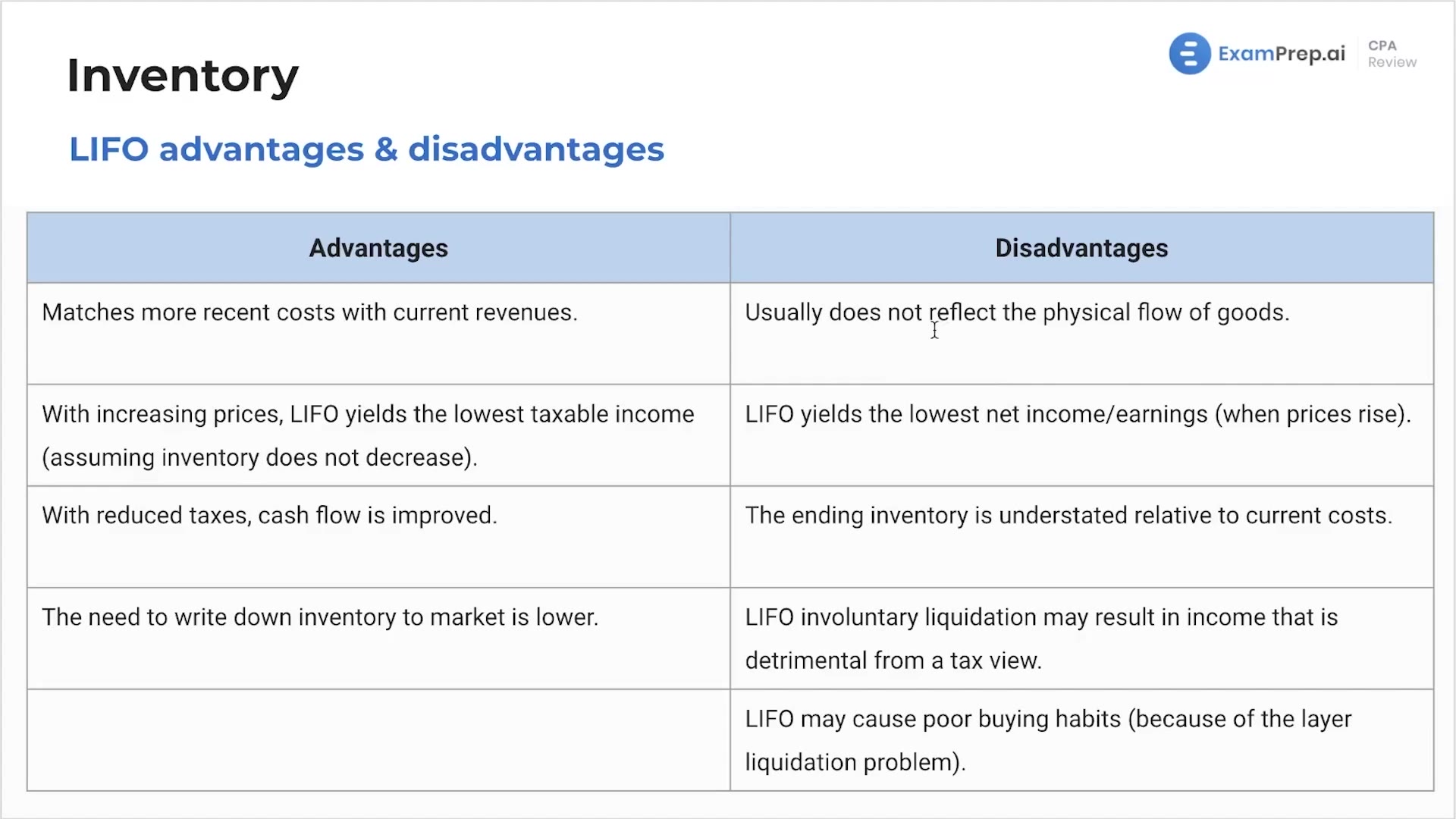

In this lesson, Nick Palazzolo, CPA, breaks down the various pros and cons of using the Last-In, First-Out (LIFO) inventory valuation method. He explains how LIFO can be advantageous for matching recent costs with current revenues, leading to lower taxable income under certain market conditions. Nick also explores the benefits of improved cash flows and a reduced likelihood of needing to write down inventory when prices are rising. On the flip side, he discusses the disadvantages, like the inconsistency of LIFO with the typical physical flow of goods and the potential for LIFO liquidations to negatively impact tax outcomes. The insights provided will shed light on how LIFO can affect a company's reported earnings and the overall implications for inventory management.

This video and the rest on this topic are available with any paid plan.

See Pricing