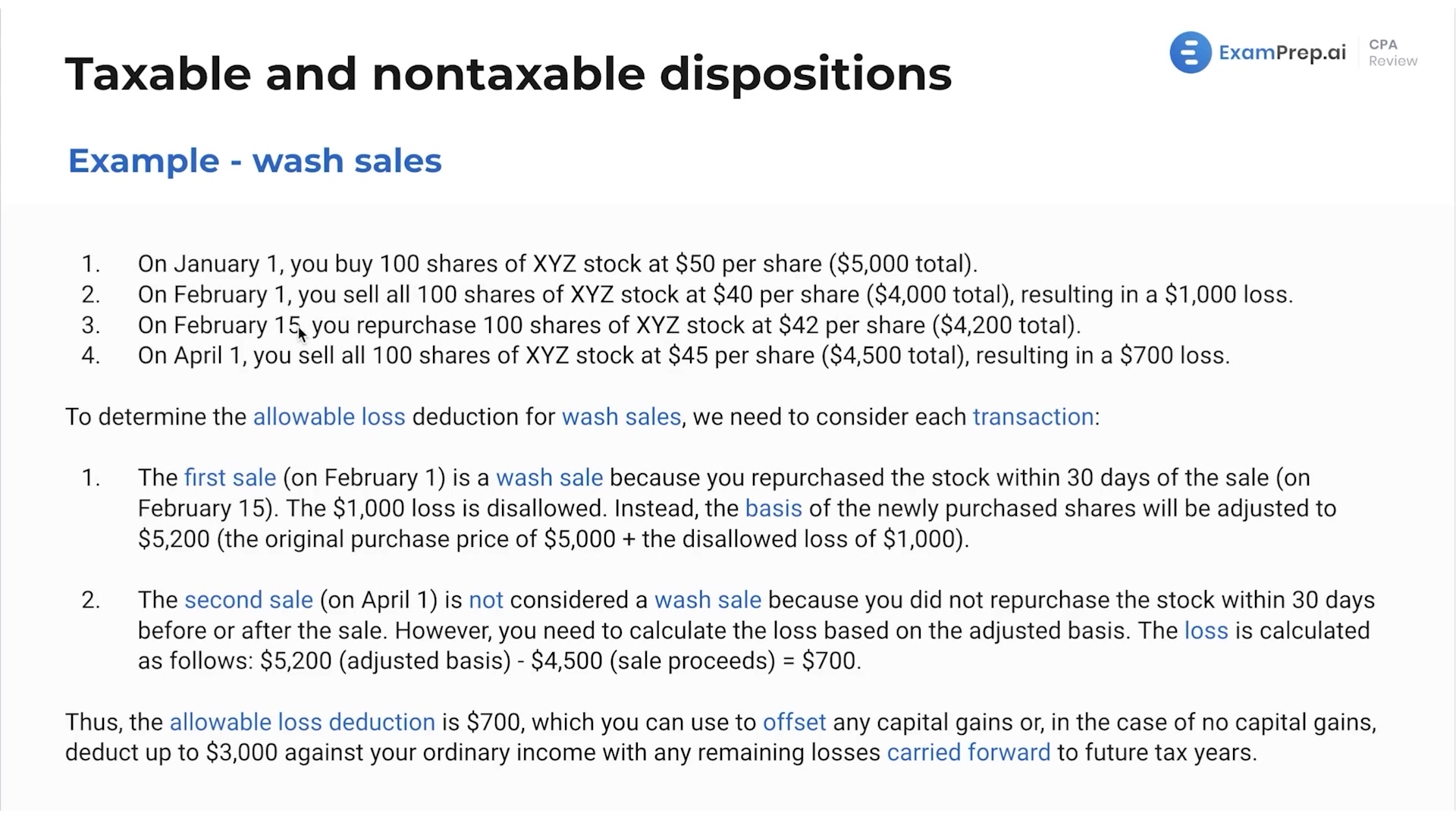

In this lesson, Nick Palazzolo, CPA, breaks down the intricacies of loss exclusions upon the disposition of assets, highlighting what can't be deducted for tax purposes. Delving into the mechanics of wash sale losses, Nick ensures clarity on how selling and then quickly repurchasing the same securities affects the deduction of losses, and their impact on the basis of newly purchased shares. The lesson also covers related party transactions and personal losses, emphasizing why certain losses cannot be leveraged for a tax benefit to prevent abuses of the tax system. Moreover, Nick's practical examples and detailed walkthrough of transactions make these complex rules relatable and easier to grasp, setting up a solid foundation for understanding the critical aspects of disallowed losses.

This video and the rest on this topic are available with any paid plan.

See Pricing