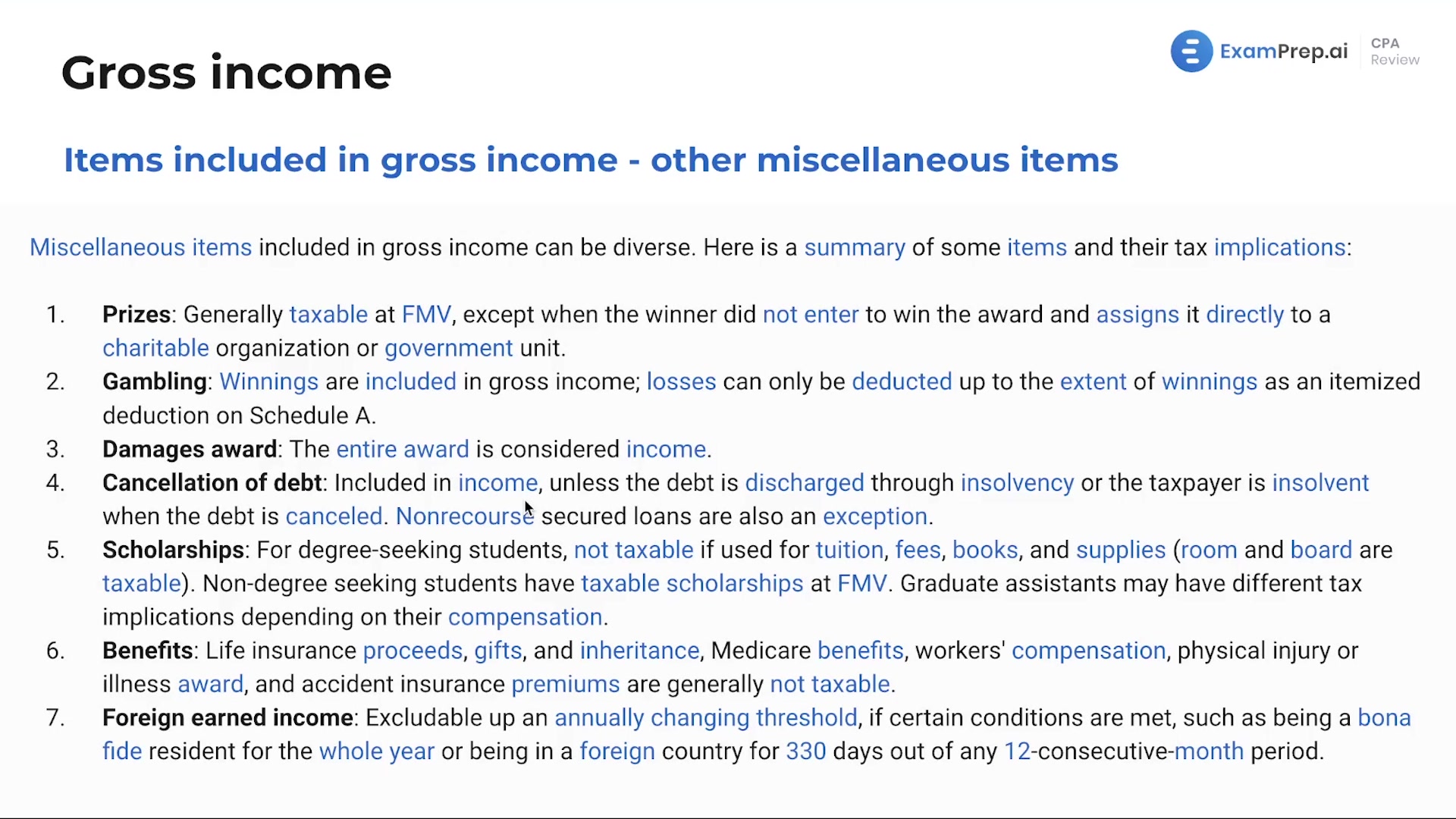

In this lesson, delve into the wide array of miscellaneous items that factor into gross income calculations. Nick Palazzolo, CPA, breaks down various income sources such as lottery winnings, gambling proceeds, certain types of damages, and the tricky subject of canceled debts. You'll explore why awards like a shiny new car from your company or a Nobel Prize could inflate your taxable income, and how to potentially exclude some awards from your tax responsibility by directing them to charity. He also clarifies the taxation of scholarships, conditions for foreign earned income exclusion, and takes you through an example with Dr. Smith's prize money to illustrate when and how awards can be tax-free. Whether dealing with debt forgiveness or pondering the tax implications of scholarships and foreign income, this lesson is designed to clarify these diverse and often confusing aspects of gross income.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free