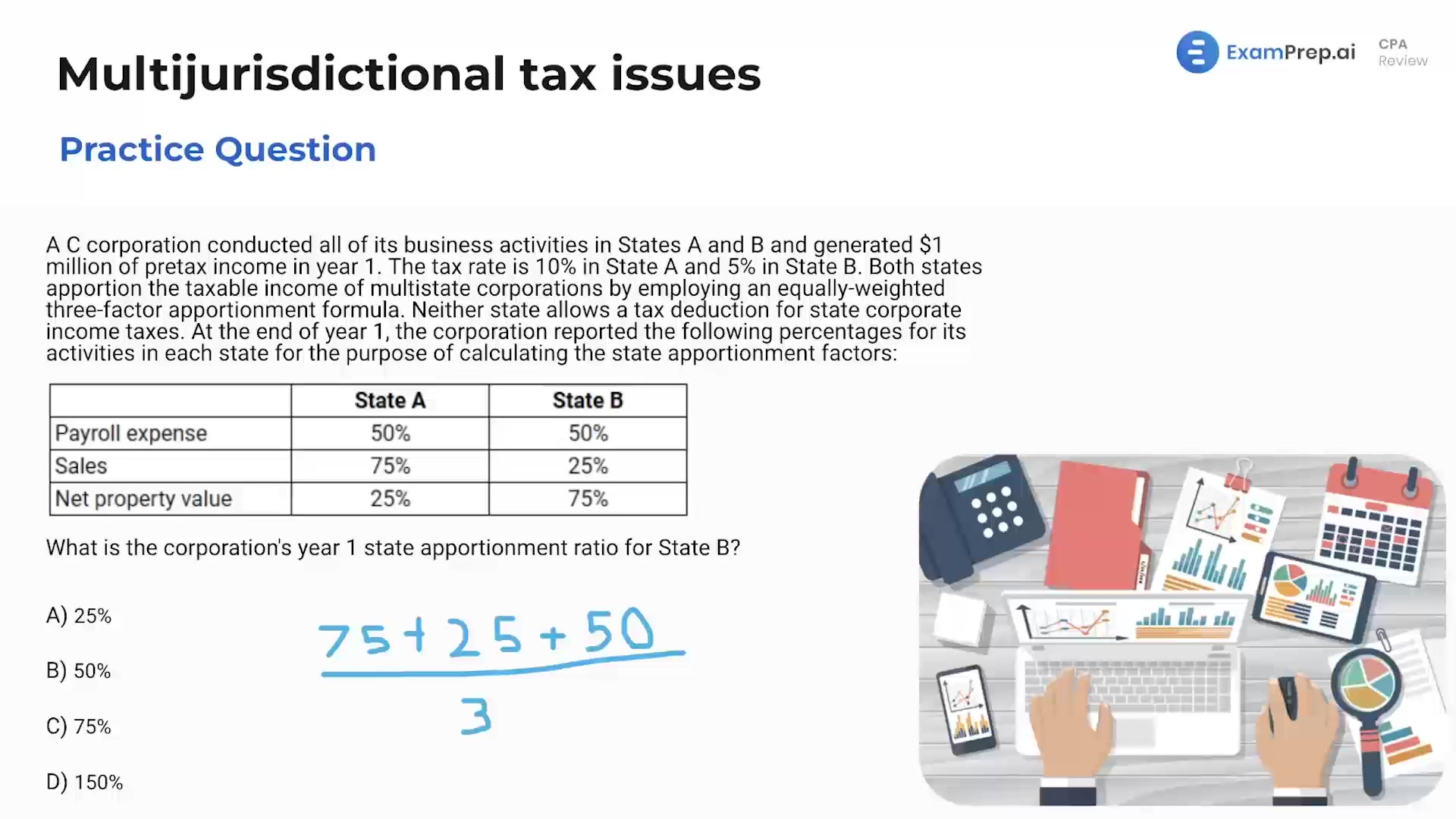

In this lesson, Nick Palazzolo, CPA, tackles the complexities of multijurisdictional tax issues through a series of practice questions, making it easier to grasp the intricacies involved. Get ready for a deep dive as Nick guides you through the calculation of a corporation's state apportionment ratio, demonstrating the process using an equally weighted three-factor formula. Later, he clarifies the conditions under which a controlled foreign corporation located in Ireland realizes subpart F income. With Nick's clear explanations, you'll learn to navigate the nuances of cross-border taxation and apply critical thinking to address potential exam questions on this topic. Keep up with Nick's logical reasoning to stay sharp and confident in tackling these multifaceted tax challenges.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free