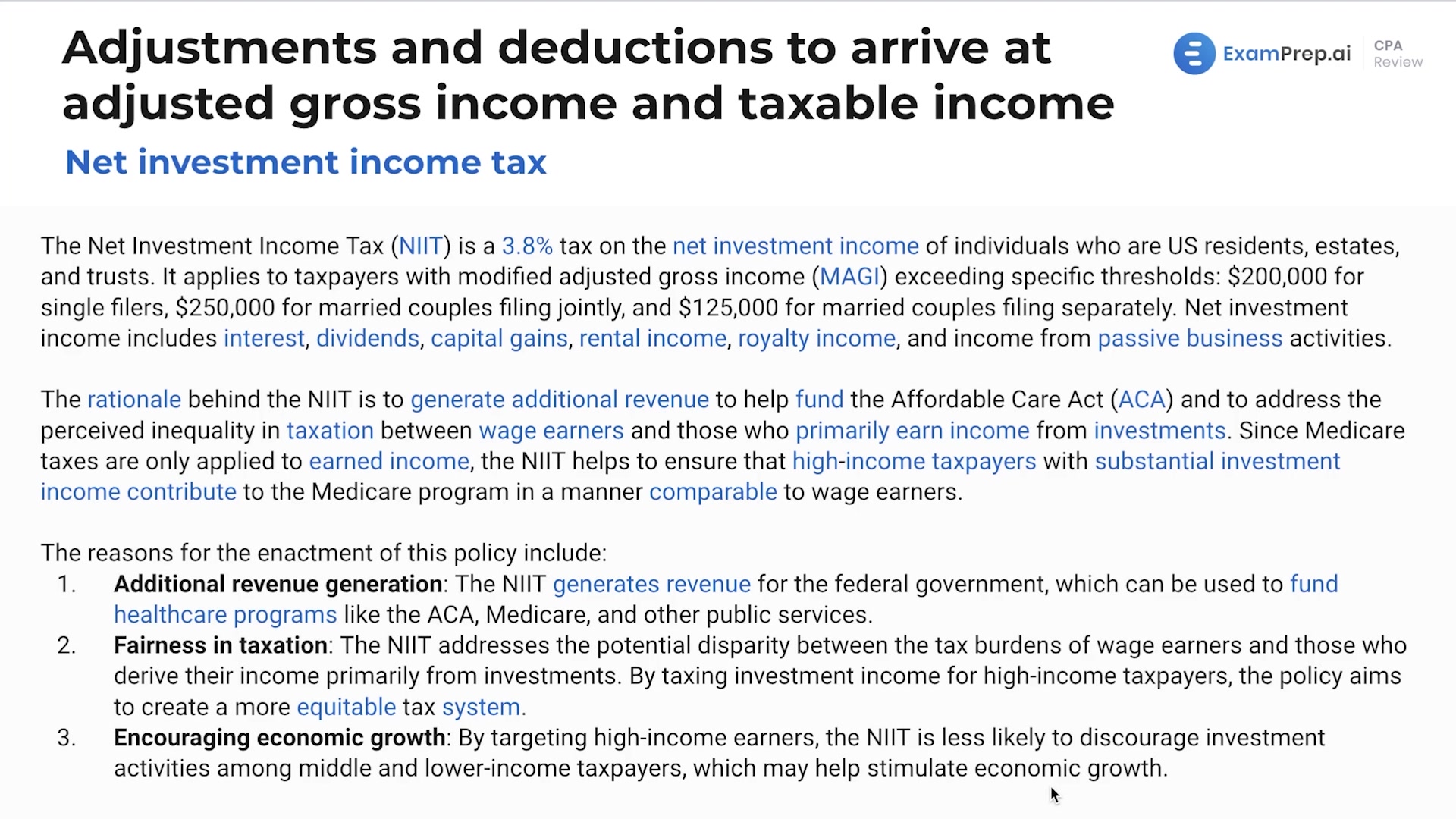

In this lesson, Nick Palazzolo, CPA, demystifies the concept of Net Investment Income Tax (NIIT), a tax that might seem convoluted at first glance. He delves into the circumstances that trigger this 3.8% tax on individuals' net investment income and the specifics about taxpayer categories affected by it, focusing on income thresholds such as those for single filers and married couples. With the help of tangible examples, he clarifies how the tax is applied to investment income exceeding the mentioned thresholds, offers insight into the reasoning behind its creation, related to the Affordable Care Act, and discusses NIIT’s role in addressing taxation inequality. Moreover, Nick helps cut through the confusion regarding the calculation of this tax, even breaking down the acronyms and terms to ensure every intricate detail is crystal clear.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free