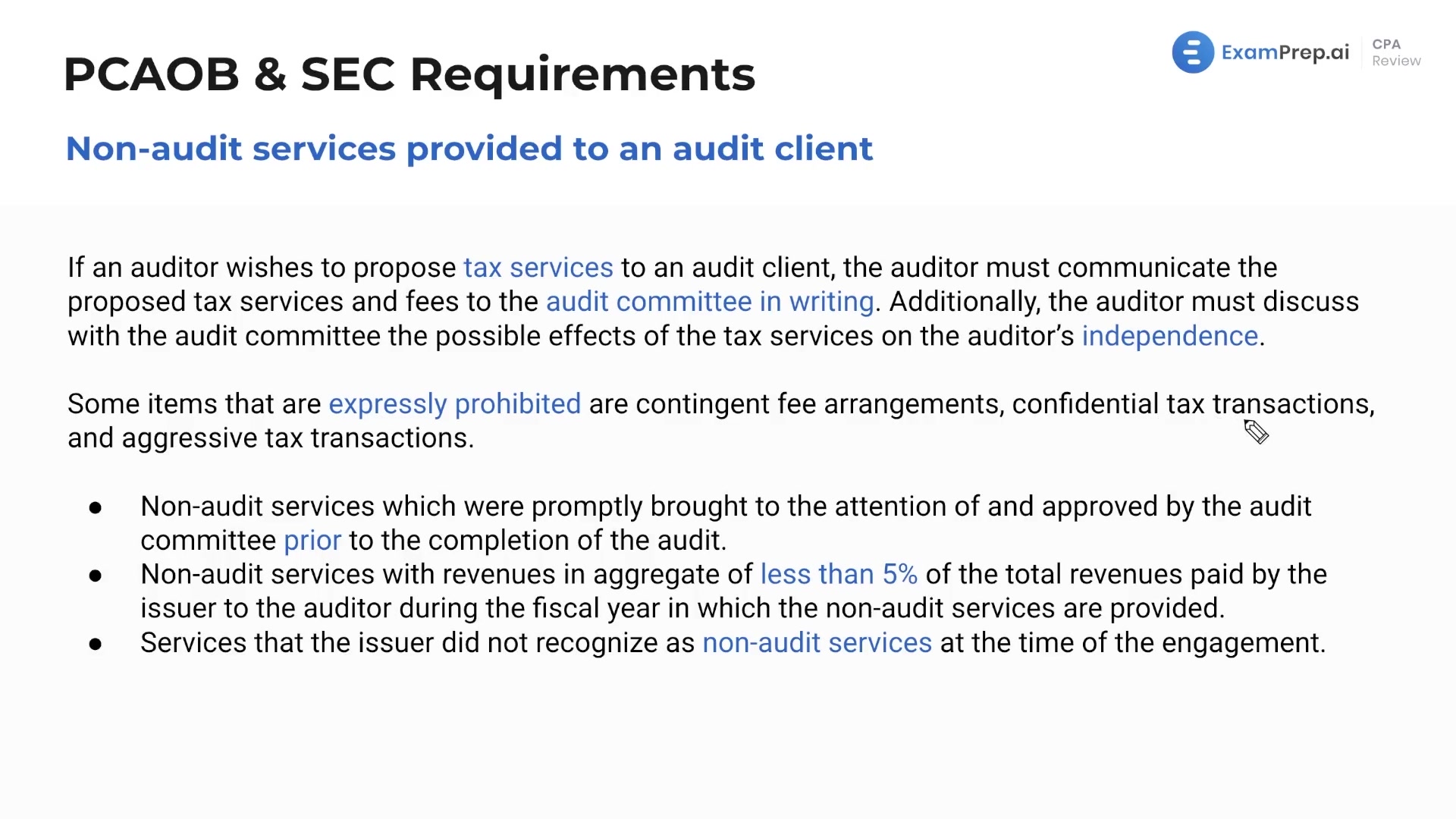

In this lesson, Nick Palazzolo discusses the requirements and limitations related to non-audit services provided to an audit client. The lesson covers rules and regulations surrounding the communication of tax services, discussing potential effects on independence with the audit committee, and items that are considered expressly prohibited when providing non-audit services. Additionally, the lesson touches on non-audit services that must be brought to the attention of and approved by the audit committee prior to the completion of the audit, and restrictions related to the percentage of total revenues these services can contribute to an auditor's income. Finally, the lesson covers situations where certain services may not have been recognized as non-audit services at the time of engagement and how these are prohibited.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free