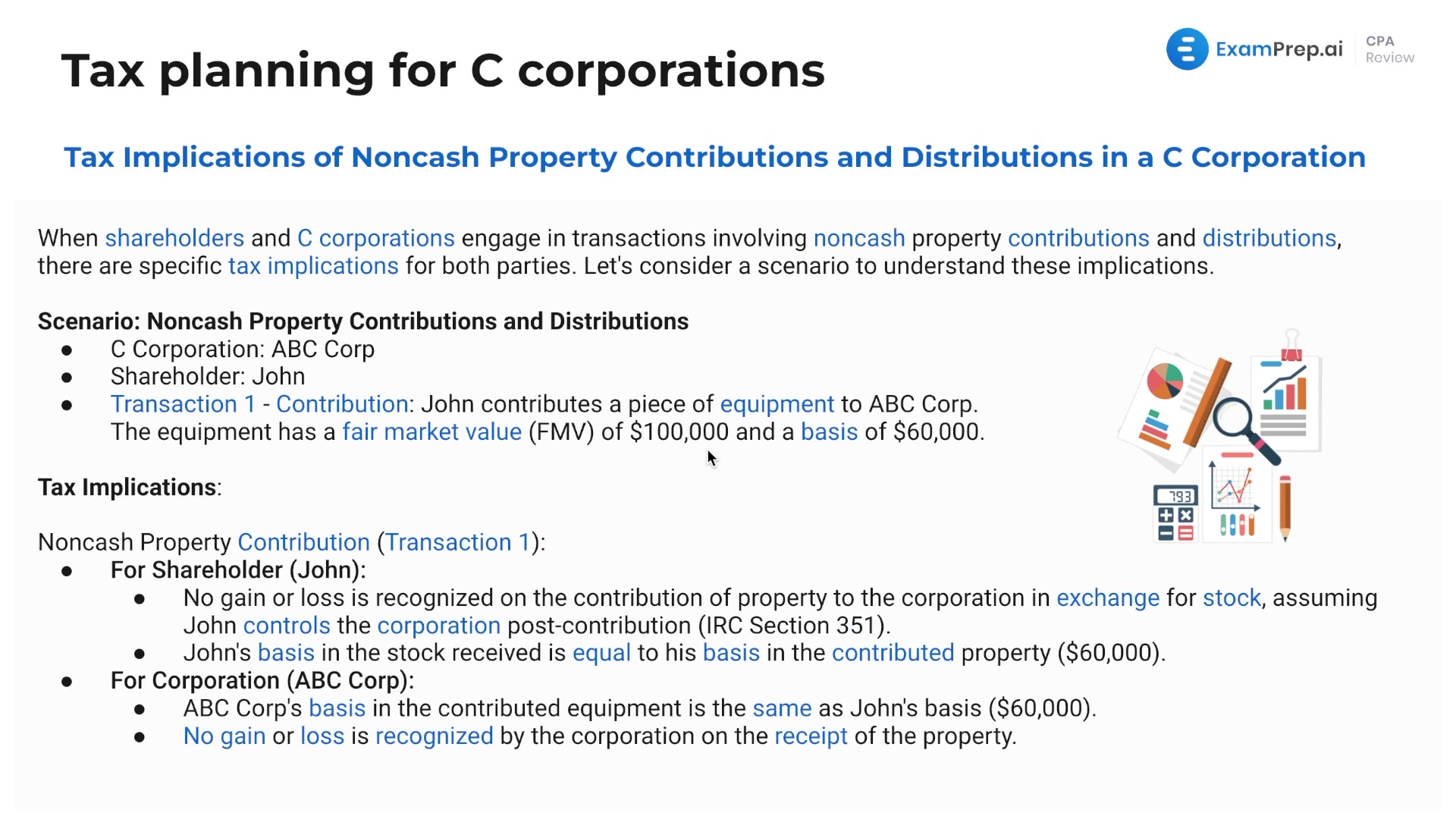

Tax planning for C corporations involves strategizing to minimize tax liability through lawful use of tax laws and regulations while considering the timing of income, deductions, and credits, and the selection of investments and types of revenue.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free