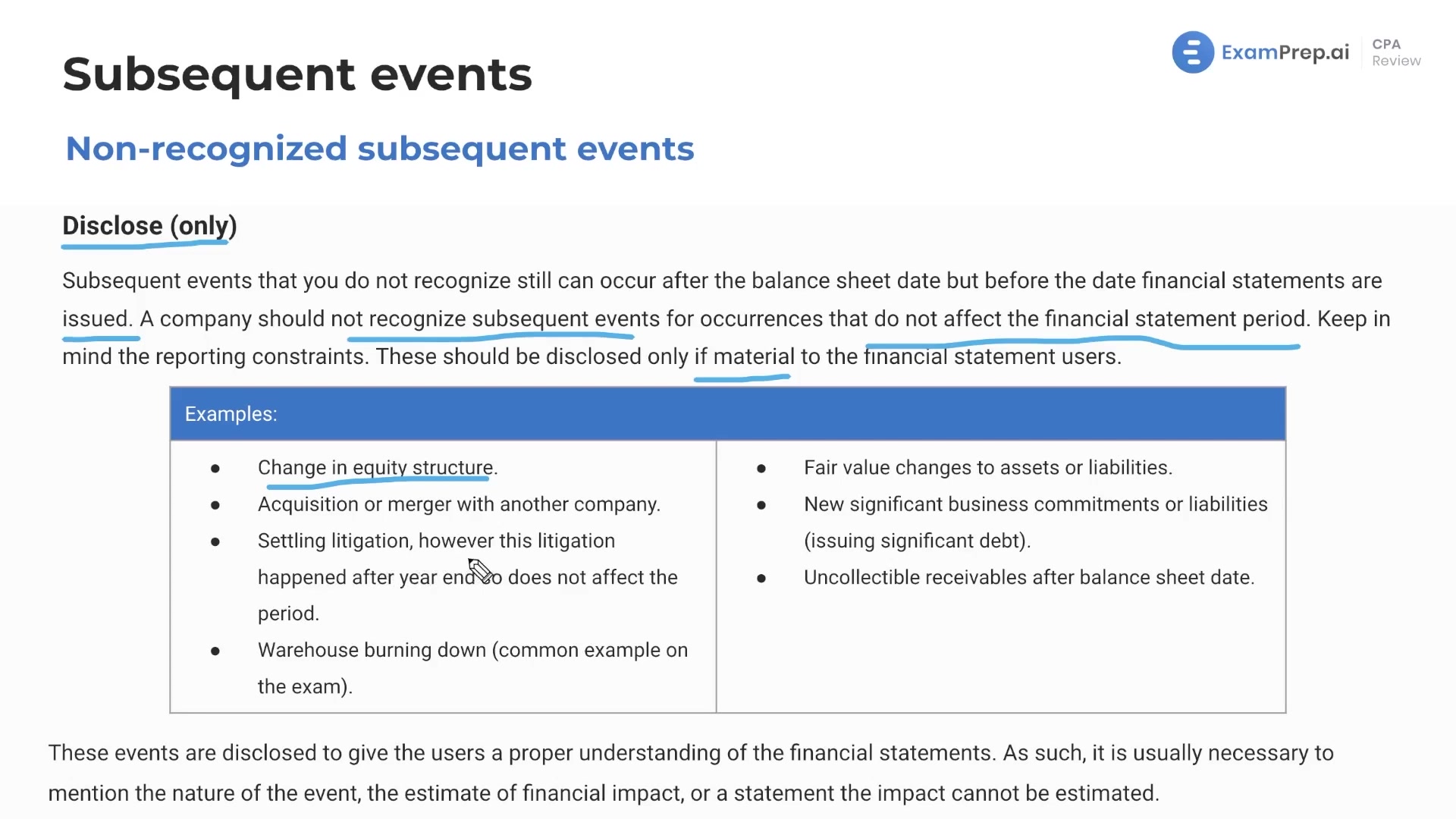

In this lesson, Nick Palazzolo, CPA, discusses non-recognized subsequent events. These events occur after the balance sheet date but before the financial statements are issued, and they require disclosure rather than recognition in the financial statements. These disclosures are necessary when the events are material to the financial statement users. Some examples include significant changes in equity structure, acquisitions, litigation settlements, and changes in the fair value of assets or liabilities. The lesson emphasizes the importance of providing users of financial statements with the necessary information to understand the company's financial position by disclosing the nature of the event, the estimated financial impact, or a statement that the impact cannot be estimated.

This video and the rest on this topic are available with any paid plan.

See Pricing