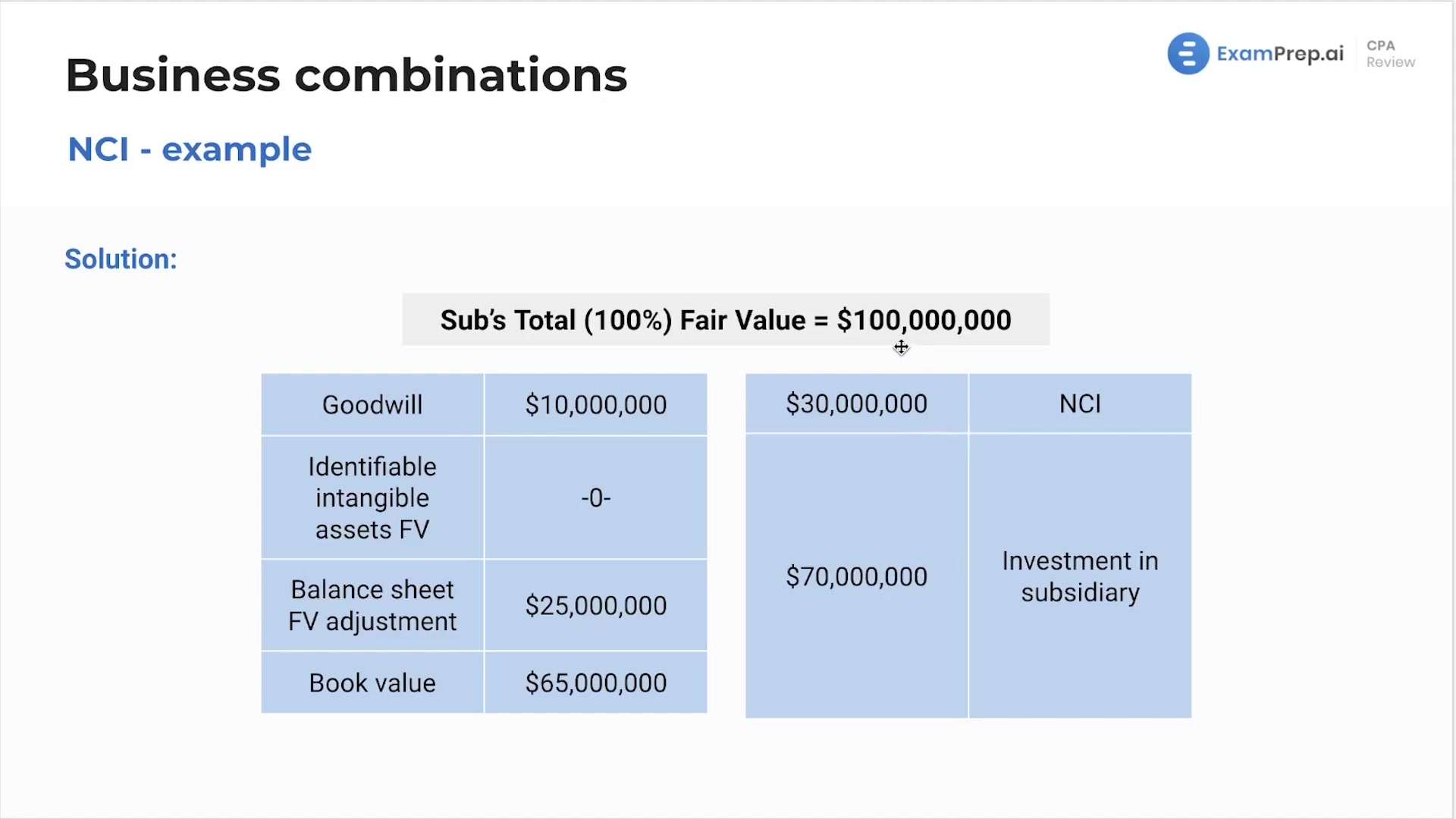

In this lesson, Nick Palazzolo, CPA, offers a practical dive into noncontrolling interest (NCI) by walking through a tangible example involving an acquisition scenario. He begins by simplifying the process of determining the NCI value when a company acquires a majority stake in another and then illustrates how fair value adjustments and goodwill are calculated in these transactions. Nick breaks down a consolidated worksheet eliminating journal entry, stressing the importance of these entries for accuracy in financial reporting. By the end, he reinforces the need to comprehend the full scope of consolidations and intercompany transactions, setting a foundational understanding that will help tackle complex business combinations and intercompany eliminations. If this lesson clicks, it's a solid sign of mastery in the consolidation segment of the curriculum.

This video and the rest on this topic are available with any paid plan.

See Pricing