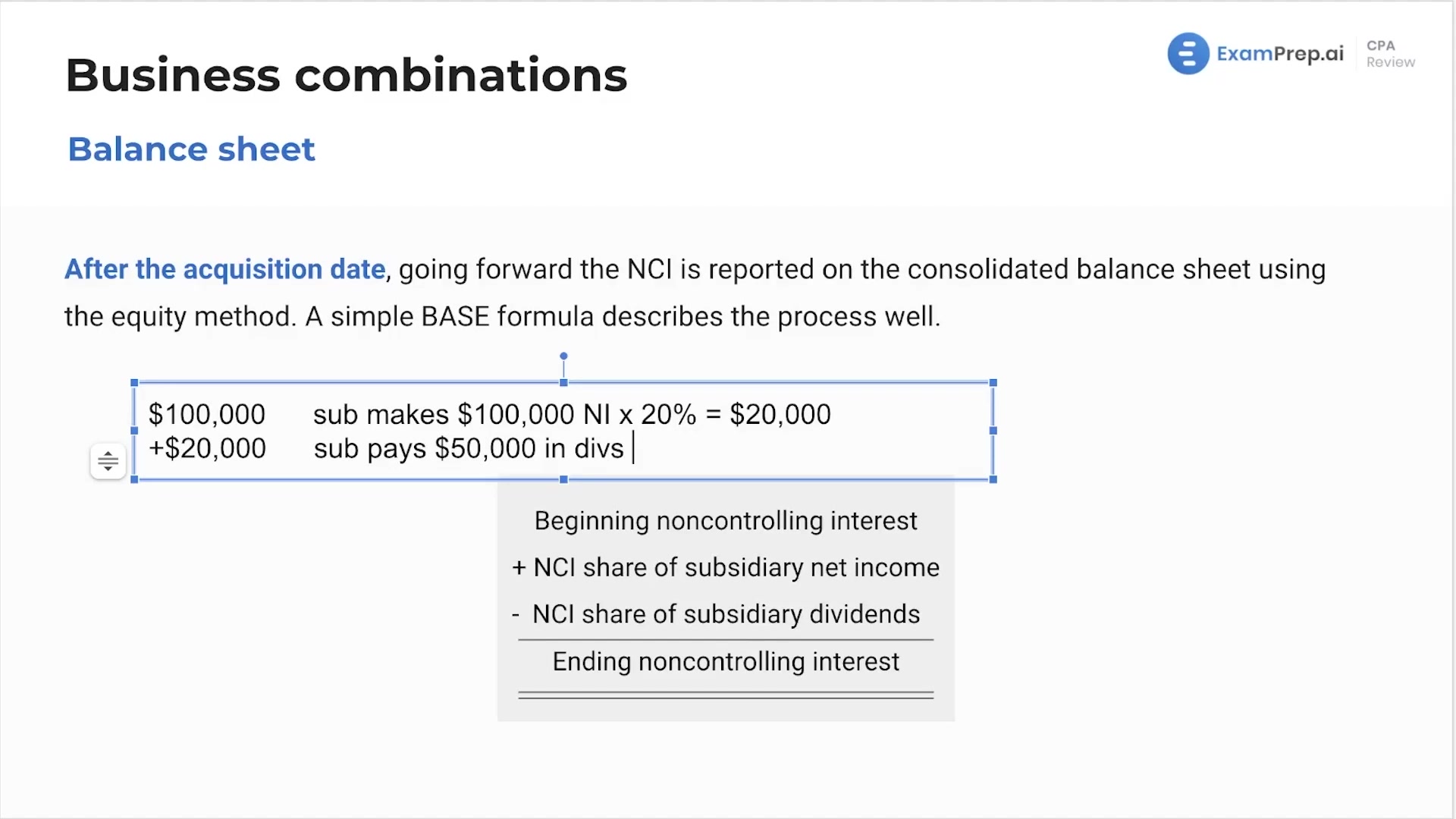

In this lesson, delve into the complexities of accounting for a noncontrolling interest (NCI) in a subsidiary. Nick Palazzolo, CPA, breaks down the scenarios and computations involved when a parent company does not have full ownership of a subsidiary. Using clear examples, he illustrates how to determine the NCI value on the consolidated balance sheet, the effects of subsidiary's net income and dividends on NCI, and the nuances of attributing profits and losses. Additionally, Nick explains how NCI impacts the consolidated income statement, ensuring a comprehensive understanding of this pivotal topic within financial reporting.

This video and the rest on this topic are available with any paid plan.

See Pricing