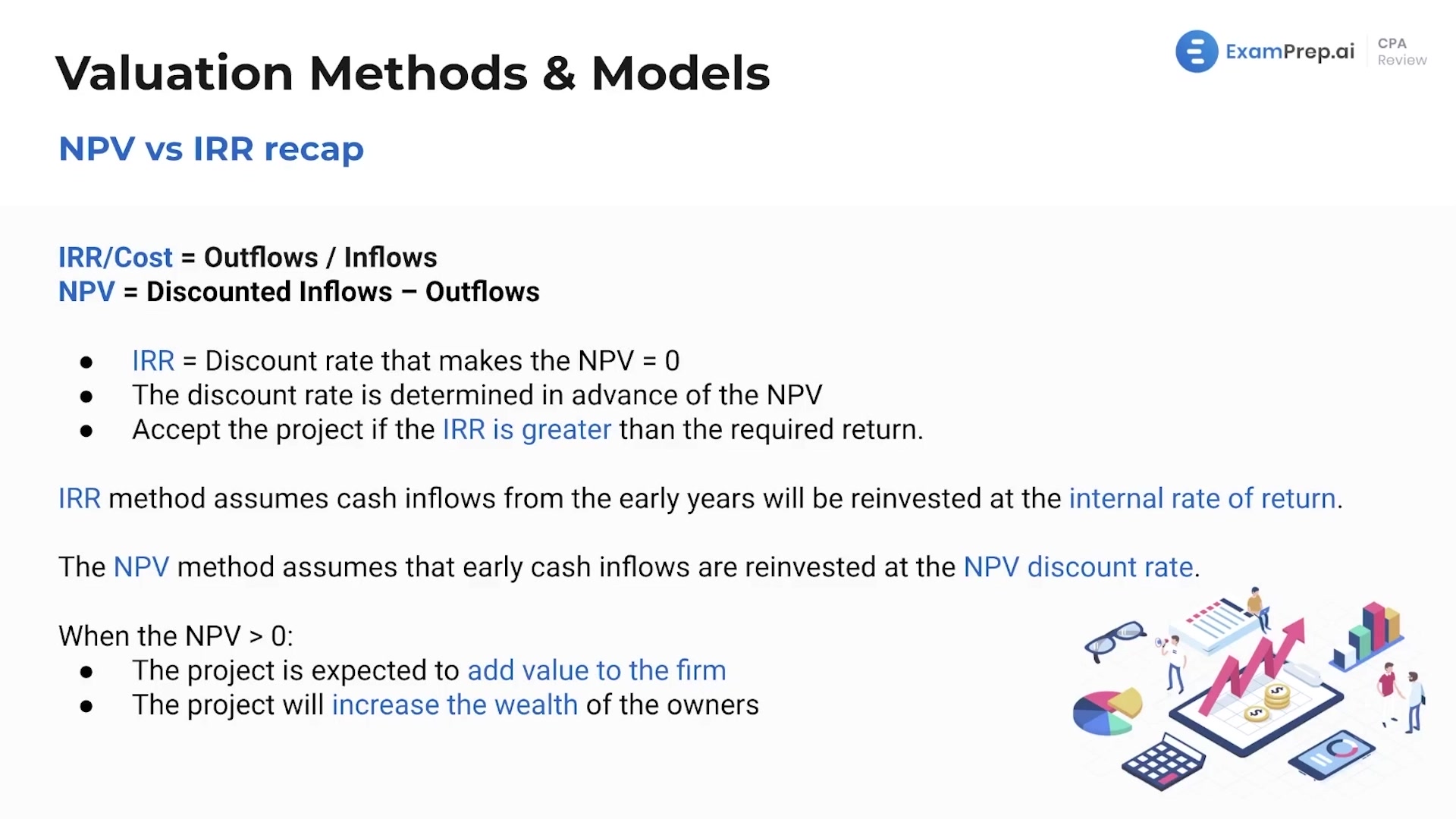

In this lesson, Nick Palazzolo, CPA, breaks down the comparison between Net Present Value (NPV) and Internal Rate of Return (IRR), crucial concepts in investment decision making. Nick clarifies when each method is applicable, detailing scenarios such as nonconventional cash flows where IRR might not be the best tool, and emphasizes the default relevance of NPV when there’s a conflict between the two. With engaging examples like Netflix’s varying cash flows, he illustrates practical applications of these investment evaluation metrics. Nick also delves into the IRR’s limitations with mutually exclusive projects and the assumptions underlying both NPV and IRR regarding reinvestment rates. Wrapping up, Nick reinforces the connection between positive NPV projects, value addition to the firm, and the subsequent increase in owner wealth, ensuring all essential points are drilled in for maximizing exam success.

This video and the rest on this topic are available with any paid plan.

See Pricing