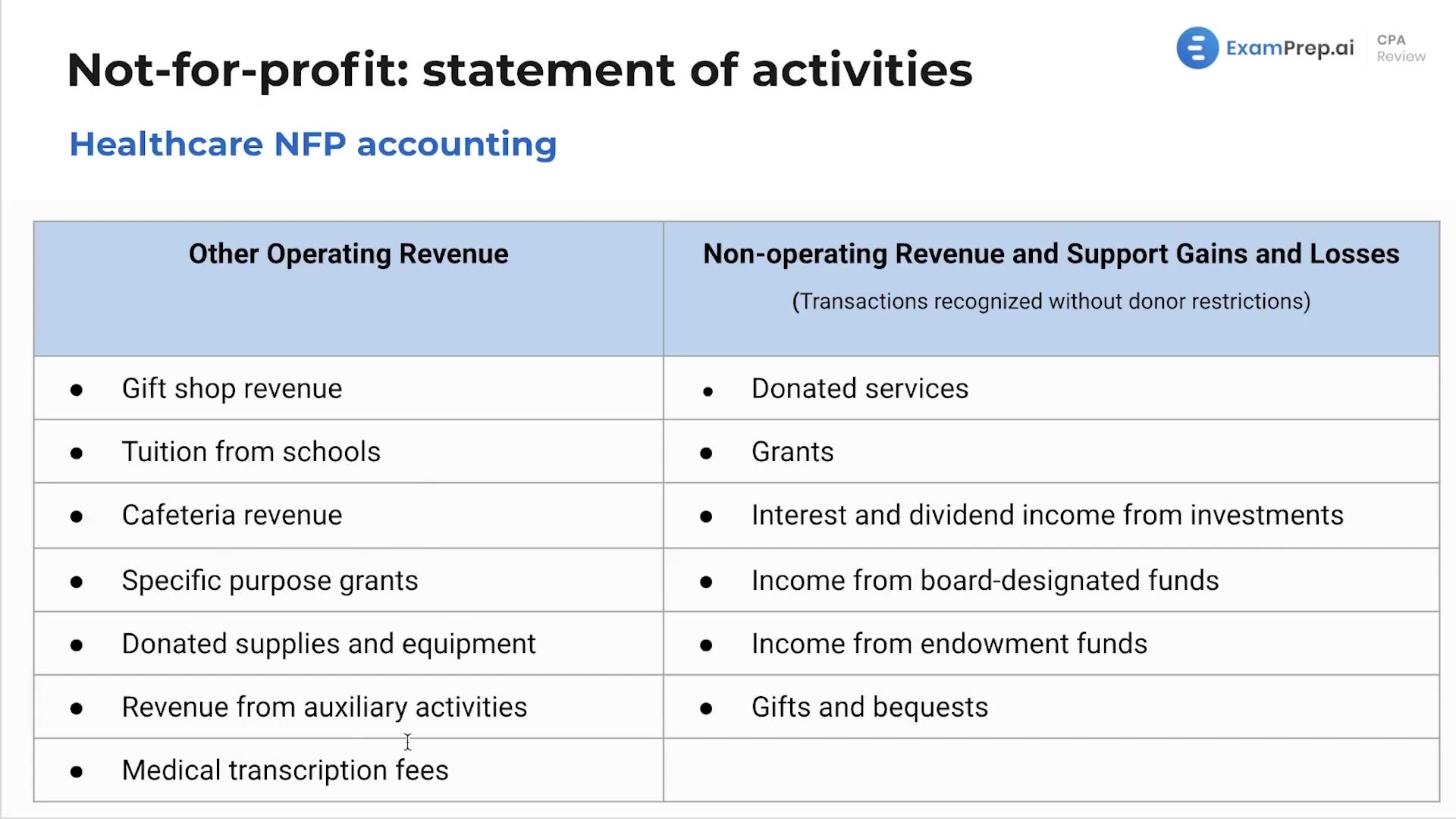

In this lesson, Nick Palazzolo, CPA, clarifies the distinction between operating and non-operating revenue, particularly within the context of a hospital's financial activities. He explains that operating revenue isn't limited to primary health services but also includes exchange-based activities such as transactions from a gift shop or cafeteria. Moreover, Nick breaks down non-operating revenue sources like donations, grants, and investment income, which are separate from the hospital's main activities. He underscores the importance of being able to classify these diverse sources of revenue correctly and offers insight on how to understand and approach this classification without the need to memorize every detail.

This video and the rest on this topic are available with any paid plan.

See Pricing