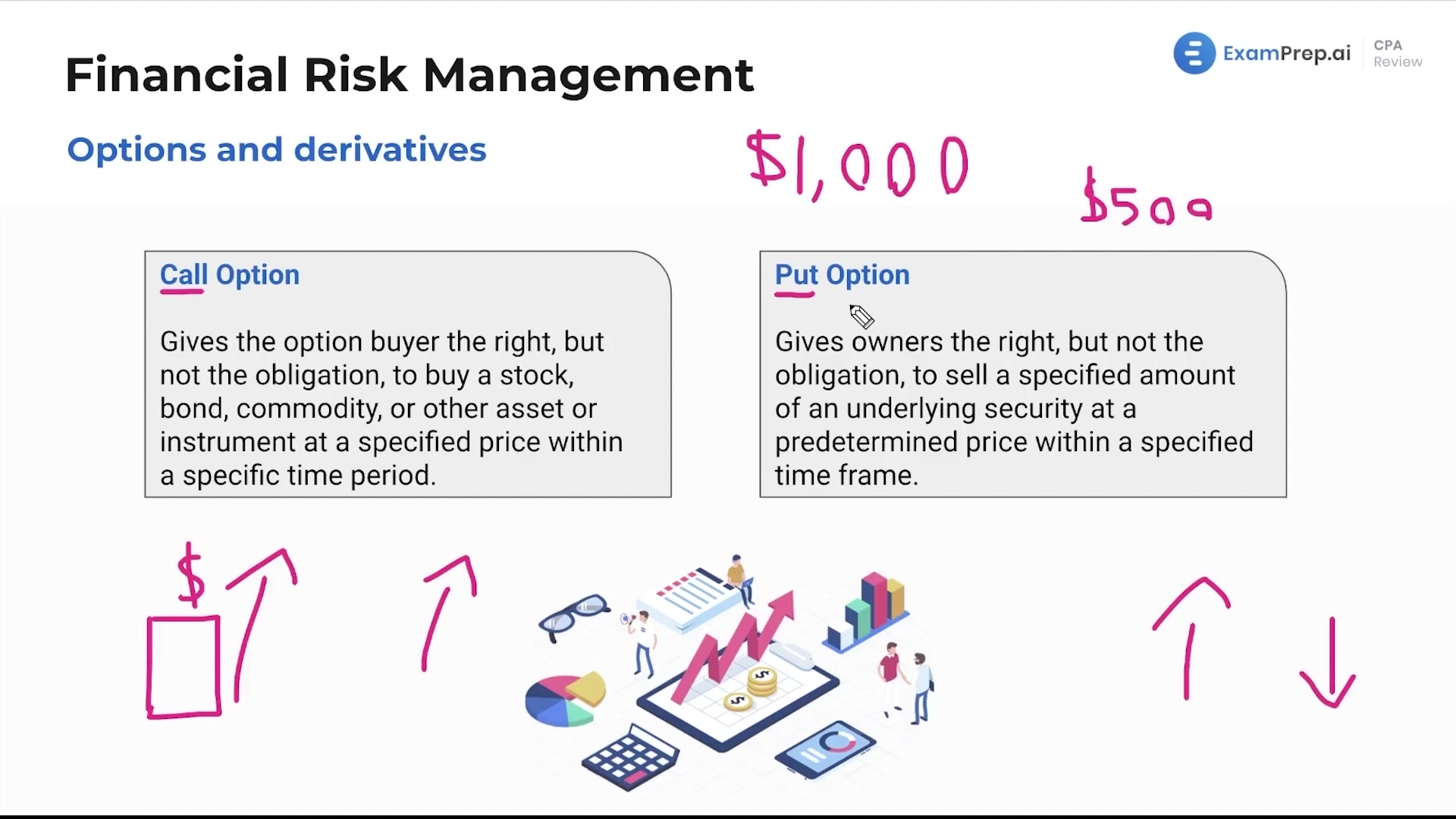

In this lesson, Nick Palazzolo navigates the complex world of options and derivatives, breaking down the essentials with an easy-to-remember analogy—calling up the stairs for calls and putting something down for puts. He simplifies the concepts by discussing how options can serve as both financial instruments and forms of insurance. By using familiar examples such as Netflix and airline companies hedging against operational risks, he demystifies why and how these entities might utilize call and put options. Nick also delves into the mechanics of buying and selling options, emphasizing their role in operational strategy rather than speculative trading. From premiums to exercising options, he ensures that the key takeaways are crystal clear, even summarizing the relevance of these instruments to business scenarios likely to be encountered on the exam.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free