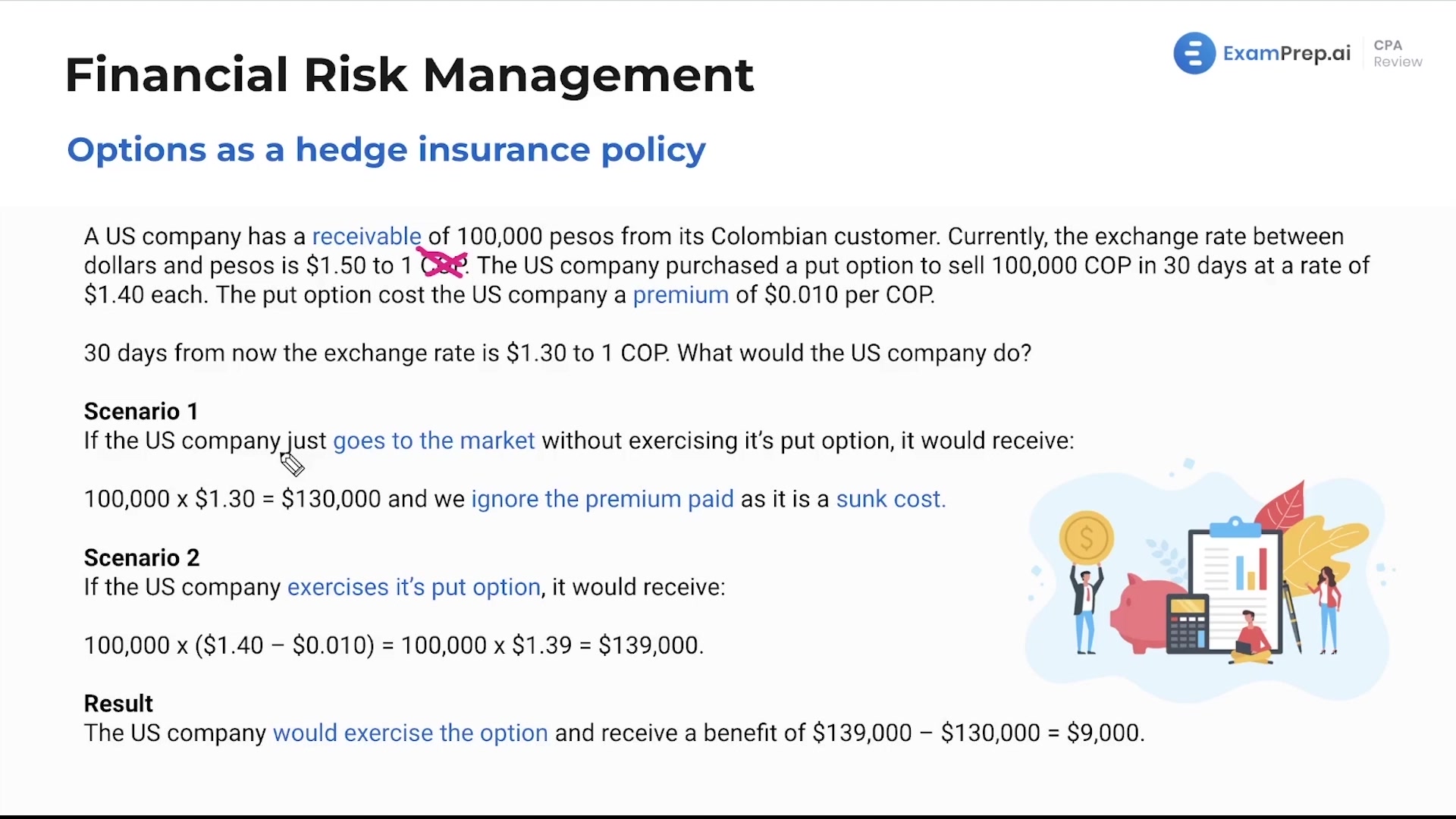

In this lesson, delve into the realm of financial risk management as Nick Palazzolo, CPA, demonstrates how options can serve as a hedge to mitigate exchange rate risk for businesses with international transactions. Explore a practical scenario where a U.S. company with a receivable in Colombian pesos uses a put option as insurance against currency fluctuations. Nick walks through the decision-making process, contrasting the outcomes of exercising the option versus going to market, and breaks down the impact on the company's finances in each situation. Get a clear understanding of how the hedging strategy effectively provides the company with a safety net, using an engaging example that underscores the benefits and mechanics of options in managing exposure to foreign exchange risk.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free