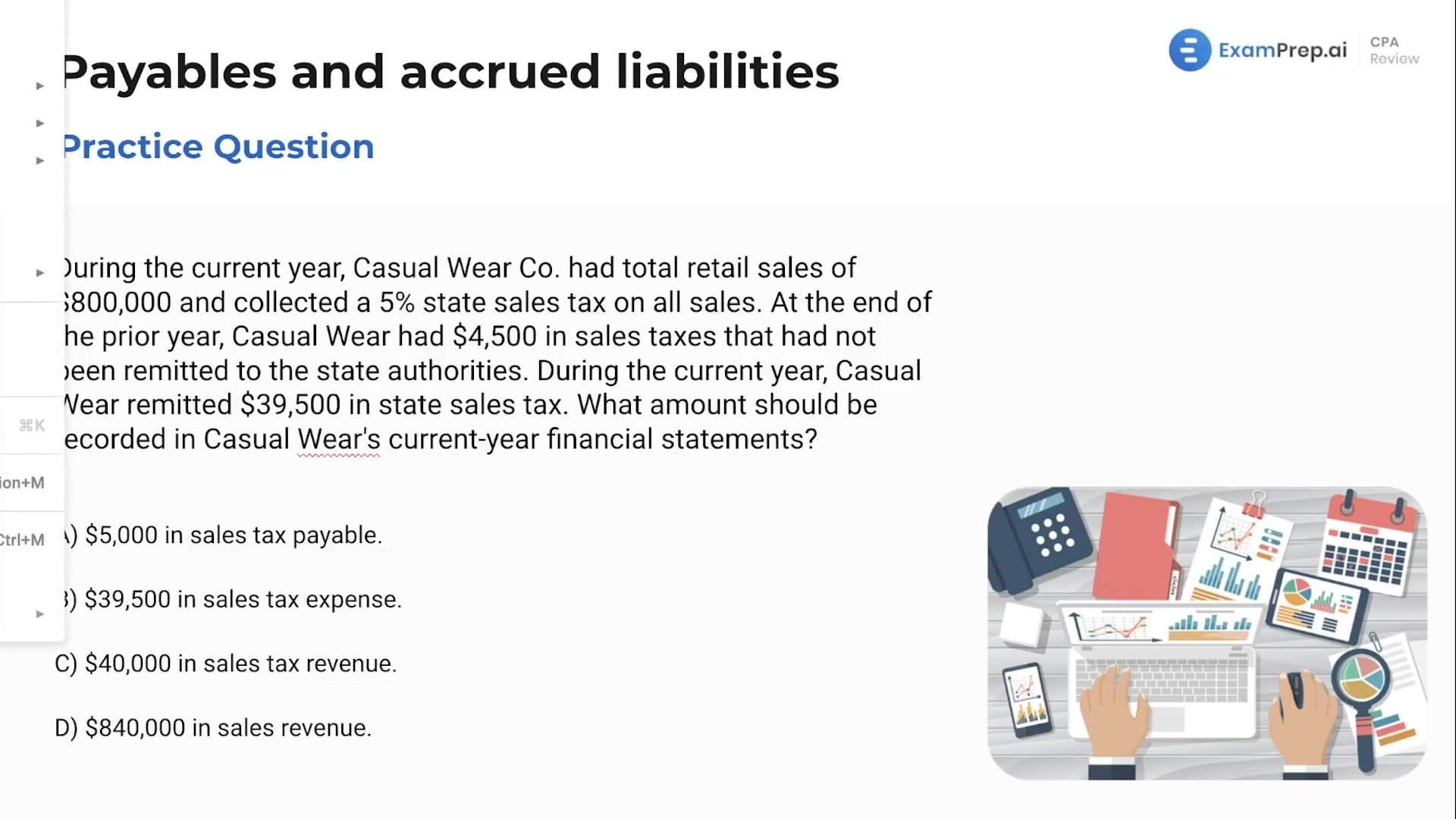

In this lesson, Nick Palazzolo, CPA, hones in on the intricacies of recording payables and accrued liabilities through a series of engaging practice questions. He leads an exploration of when a company should recognize a liability for an asset, pinpointing the critical role of terms like FOB destination and FOB shipping point in determining the ownership transfer date. Further elevating the discussion, Nick breaks down the 'base formula' to calculate year-end balances for accrued liabilities, making a complex topic accessible with clear examples and a step-by-step approach to problem-solving. Through this exercise, the subtle details of journal entries and title transfers become clear, equipping you with the know-how to tackle similar problems with confidence.

This video and the rest on this topic are available with any paid plan.

See Pricing