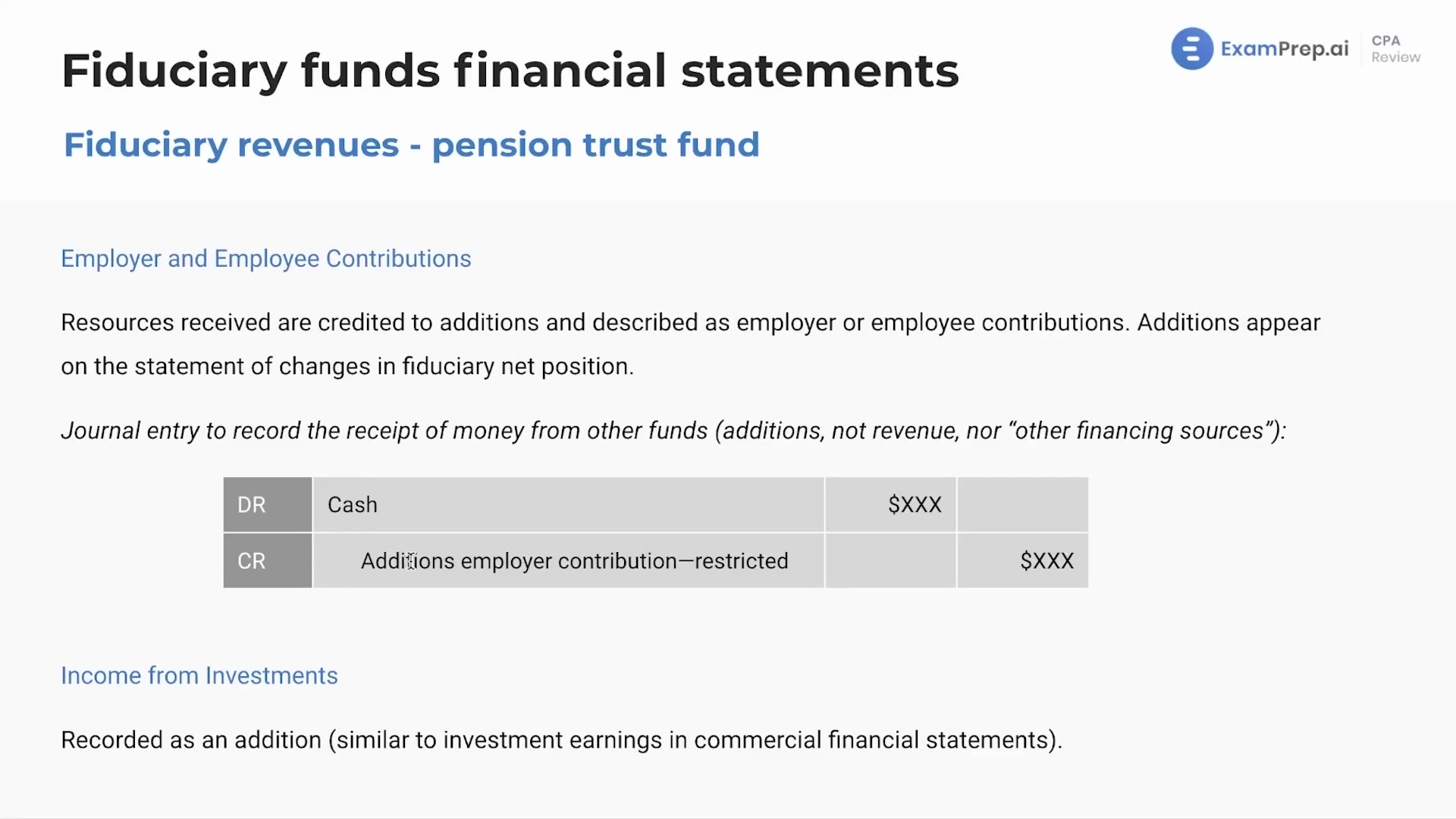

In this lesson, Nick Palazzolo, CPA, demystifies the workings of pension trust funds, which are critical for government employees' retirement plans. Delving into the practicalities of government-sponsored benefit and contribution plans, he covers the flow of transactions within these funds, including both employer and employee contributions. Nick straightforwardly explains how these contributions are recorded in the Statement of Changes in Fiduciary Net Position and how to differentiate between restricted monies and revenue. Additionally, he offers insights into the accounting treatment of investment income and highlights the types of expenses associated with pension trusts, like administrative costs and benefit payments. By the end of this lesson, the mechanisms of pension trust fund accounting are laid out in an easily digestible format, clarifying any complexities associated with this topic.

This video and the rest on this topic are available with any paid plan.

See Pricing