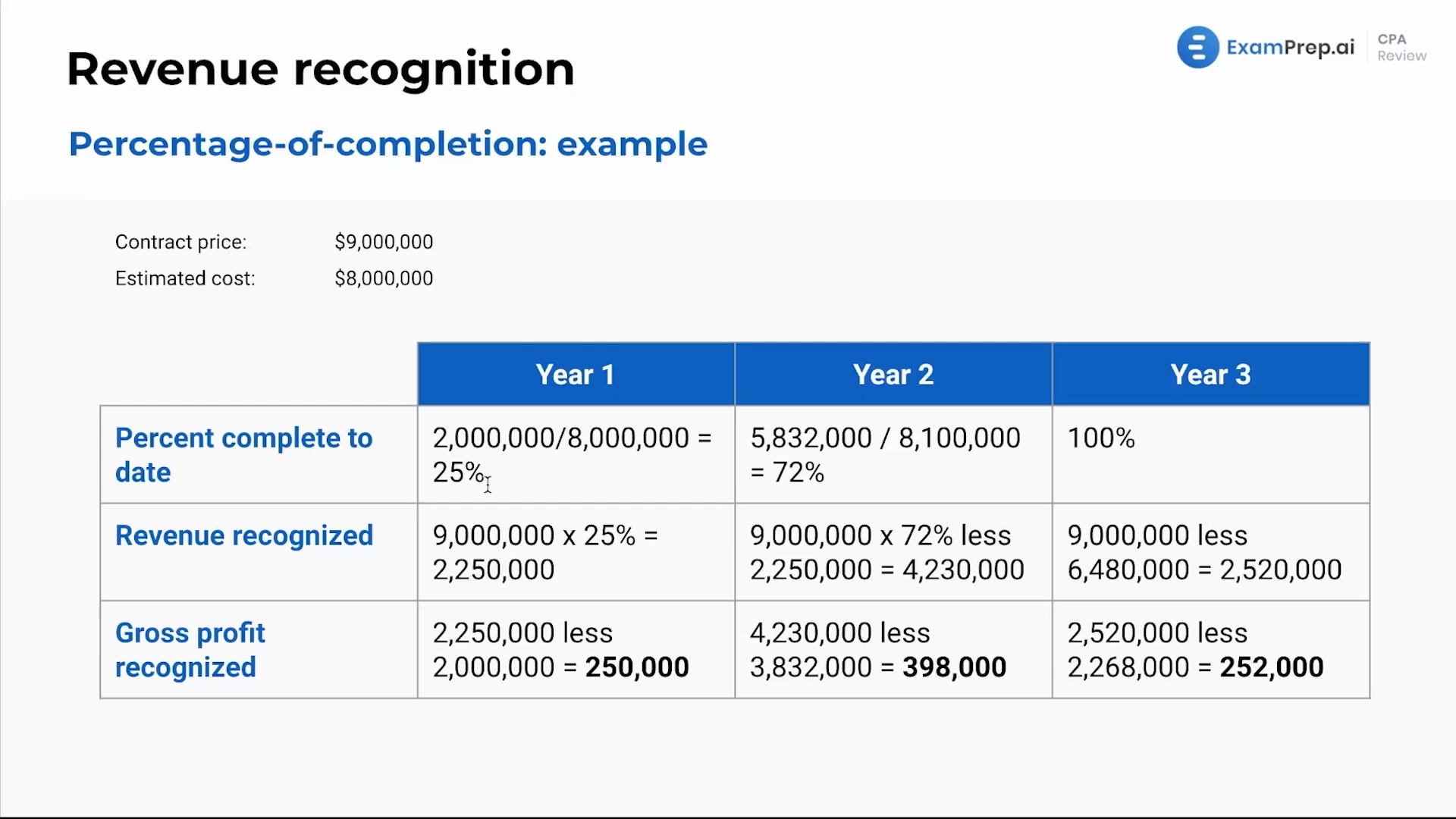

In this lesson, Nick Palazzolo, CPA, brings the Percentage-of-Completion method to life with a comprehensive example involving Mighty Construction Inc. and their contract to build a new warehouse. He meticulously walks through the process of revenue recognition under accrual basis GAAP for a long-term contract, illustrating how to calculate the progress of the project and recognize revenue and gross profit at various completion stages. Key points include sifting through the data to identify relevant figures, adjusting for changes in cost estimates, and navigating the complexities that arise when numbers aren't as clean-cut as desired. Nick also shows how to ensure there's no double-counting of revenue and the approach to finalize gross profit recognition, all while highlighting common pitfalls and the importance of checking work for accuracy.

This video and the rest on this topic are available with any paid plan.

See Pricing