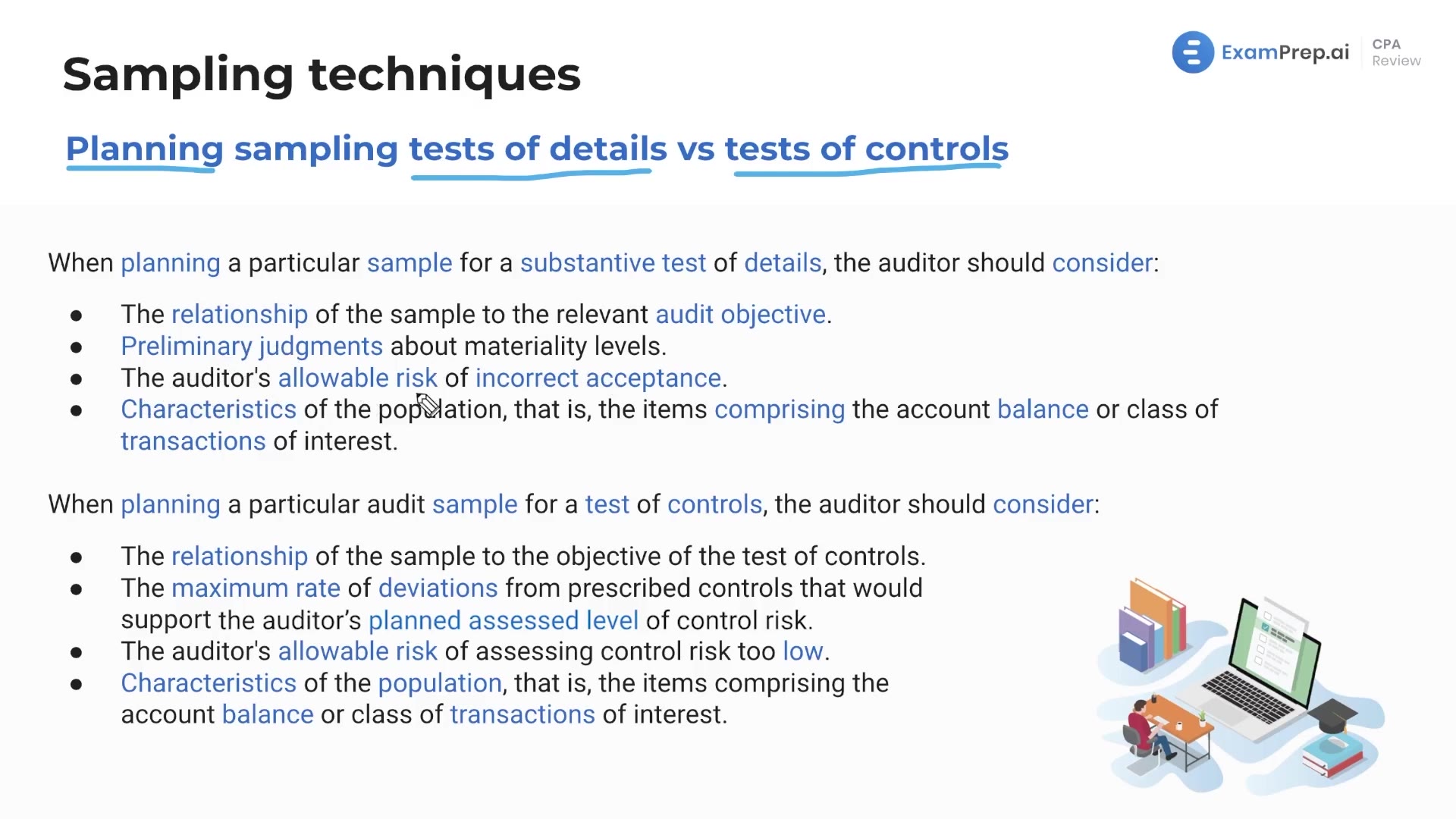

This lesson focuses on the planning aspects of audit sampling for both substantive tests of details and tests of controls. For substantive tests of details, considerations include the relationship of the sample to the relevant audit objective, preliminary judgments about materiality levels, the allowable risk of incorrect acceptance, and the characteristics of the population. For tests of controls, the considerations involve the relationship of the sample to the objective, determining the maximum rate of deviations from prescribed controls, and the allowable risk of assessing control risk too low. All these factors are essential in determining the appropriate sample size and sampling techniques used during the audit process.

This video and the rest on this topic are available with any paid plan.

See Pricing