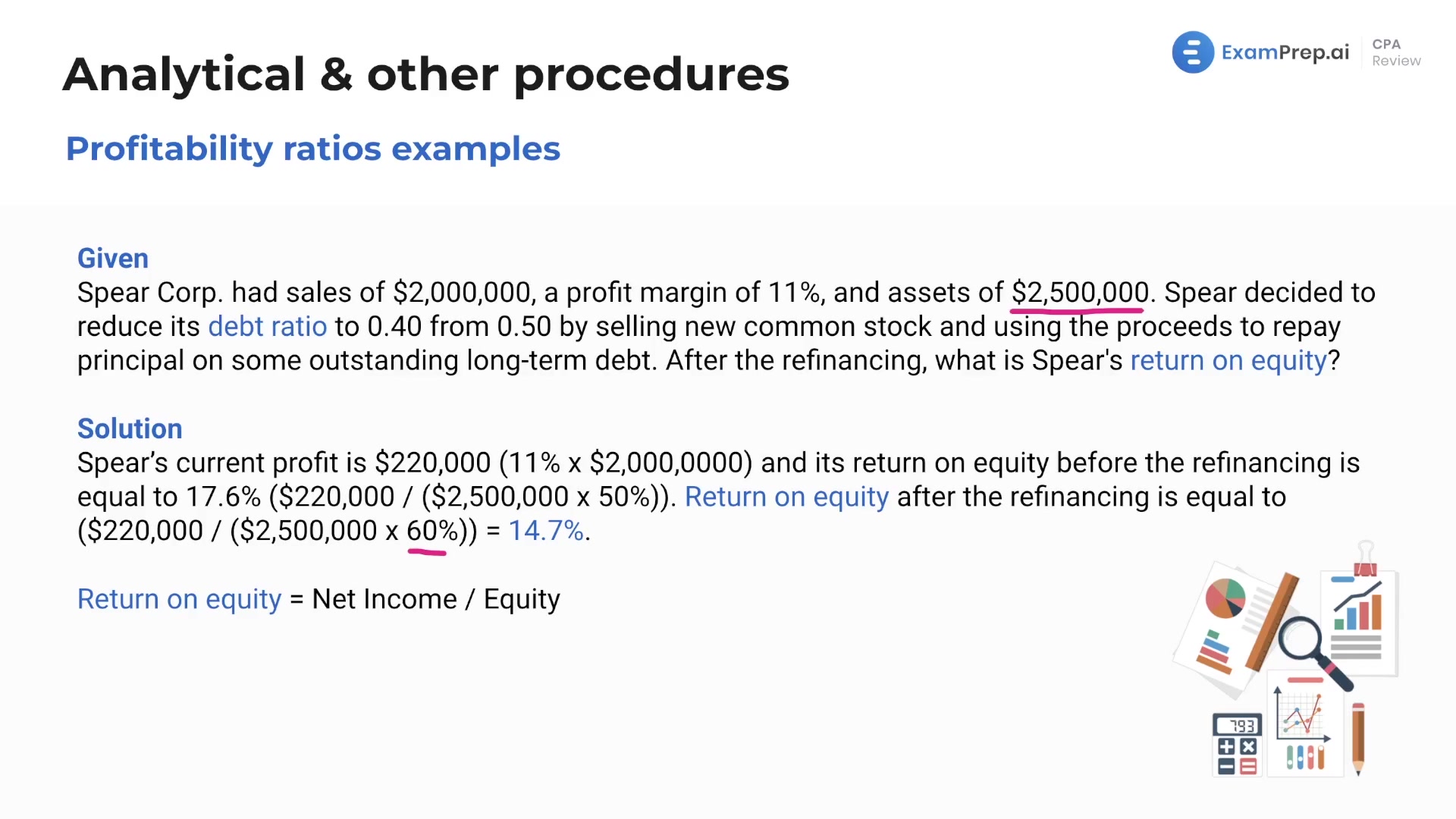

In this lesson, the concepts and calculations of profitability ratios are thoroughly explained by Nick Palazzolo, CPA. Profitability ratios indicate how effectively a company is utilizing its resources and generating income. The lesson covers various profitability ratios, such as return on equity, return on assets, return on sales and return on investment, and explains their significance and interpretation. Through a series of practical examples, learners understand how to calculate these ratios using real-life financial data. Nick highlights the importance of having a higher net income for lower assets, equity, and initial investments and demonstrates how these metrics can be compared across companies and industry averages.

This video and the rest on this topic are available with any paid plan.

See Pricing