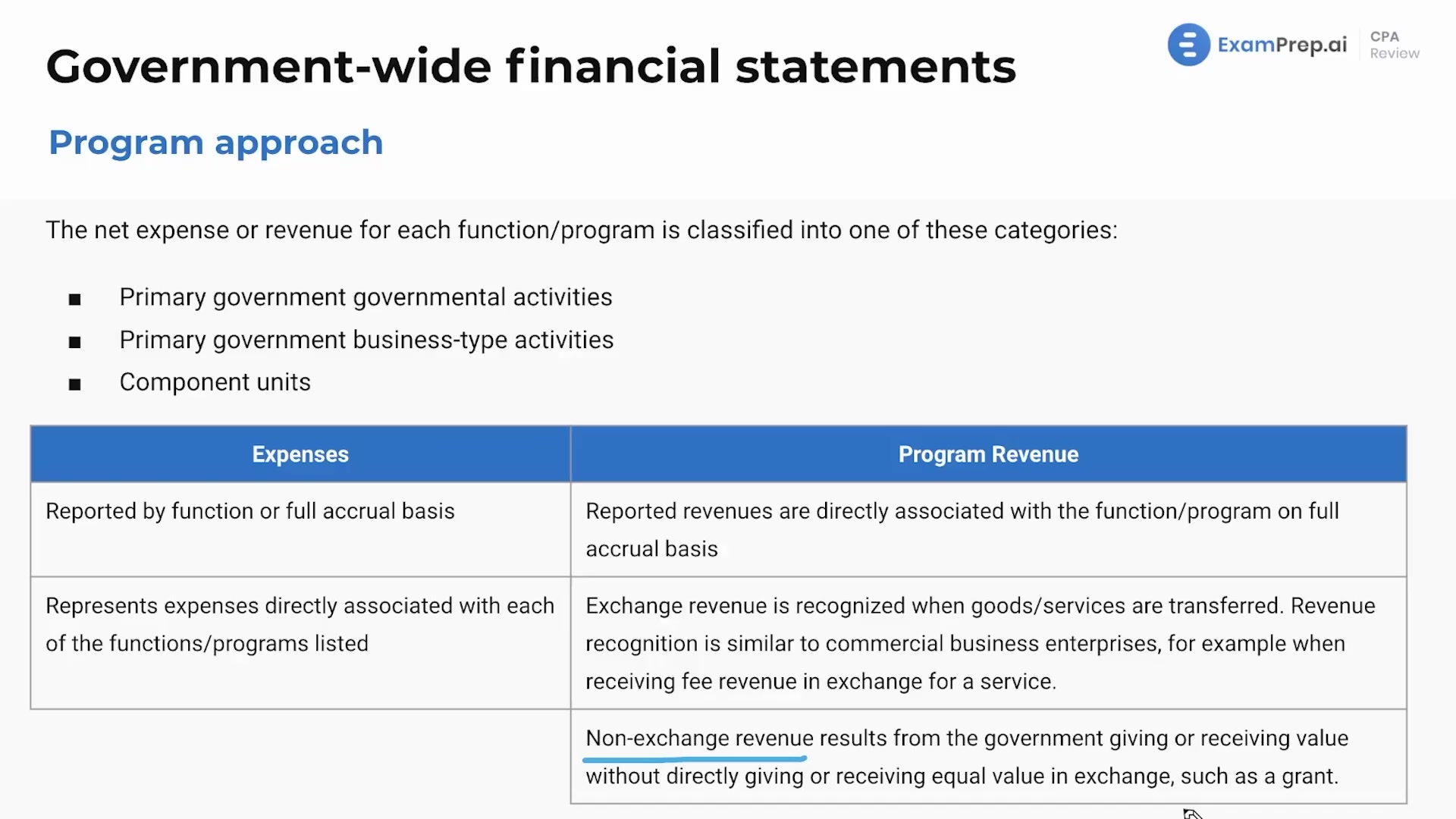

In this lesson, grasp the complexities of revenue recognition in a governmental context with Nick Palazzolo, CPA, who illuminates the distinctions between expenses reported by function and on a full accrual basis. Nick breaks down program revenues, discussing how they correlate directly with specific functions or programs and contrasts exchange revenue with non-exchange revenue. Engage with real-world examples such as fees to use a public pool and the allocation of government grants, helping to solidify the understanding of how governments both collect and distribute funds. Furthermore, Nick dives into charges for services, operating and capital grants, and contributions, fleshing out the nuances between them and how they support different governmental programs and services.

This video and the rest on this topic are available with any paid plan.

See Pricing