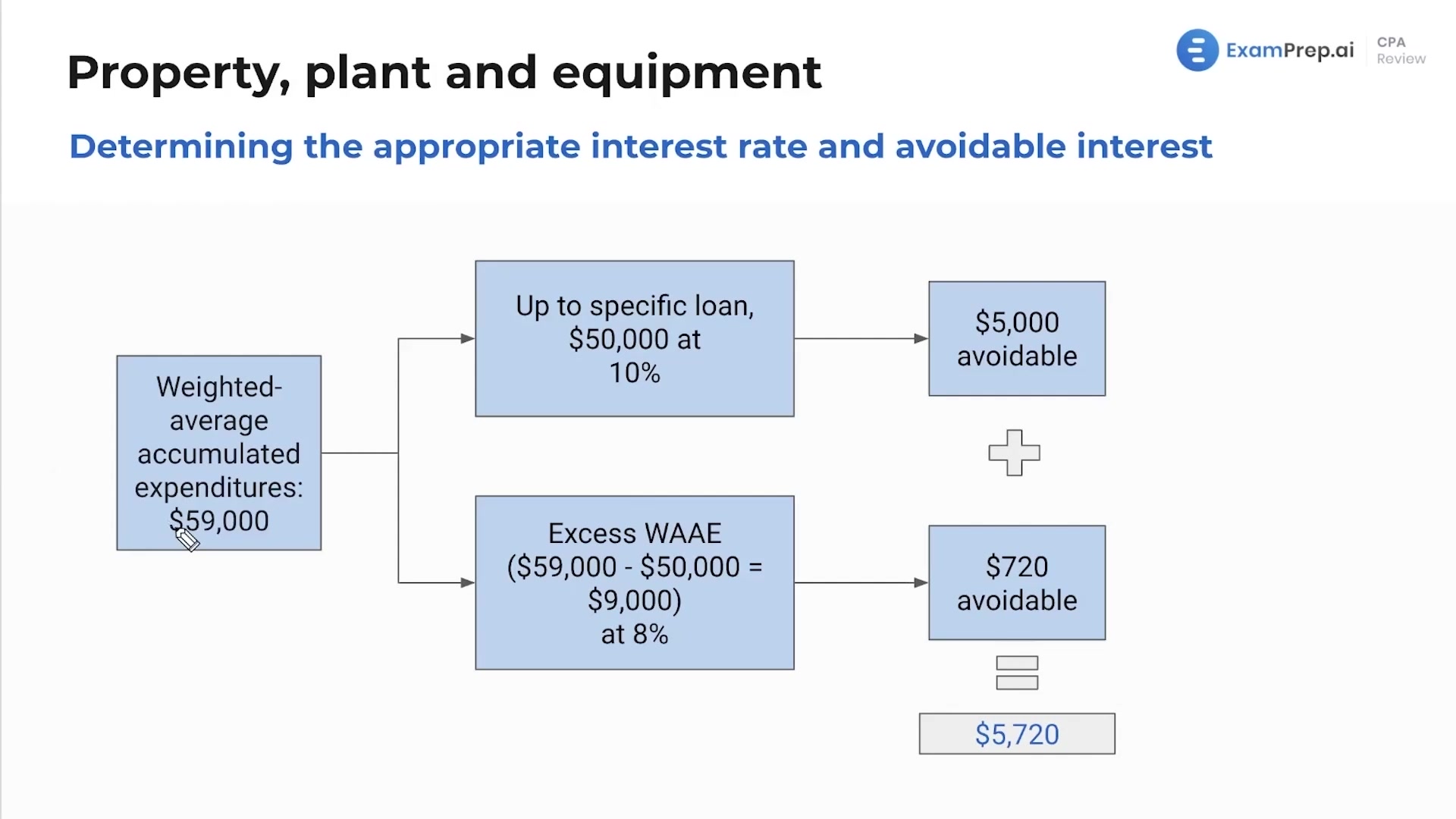

In this lesson, Nick Palazzolo, CPA, takes a dive into the intricate process of calculating capitalization of interest on Property, Plant, and Equipment (PP&E) with concrete numerical examples. He walks through the method of determining weighted average accumulated expenditures, illustrating how different costs are effectively prorated over time. As the lesson unfolds, Nick clarifies the distinction between specific and other debts, detailing how only interest related to the project is capitalized. He patiently breaks down the concept of avoidable interest, demonstrating the calculation with practical samples and stressing the importance of refinancing scenarios. By the end, the lesson clearly differentiates between the capitalization and expensing of interest, ensuring the nuances of these essential accounting practices are well understood.

This video and the rest on this topic are available with any paid plan.

See Pricing