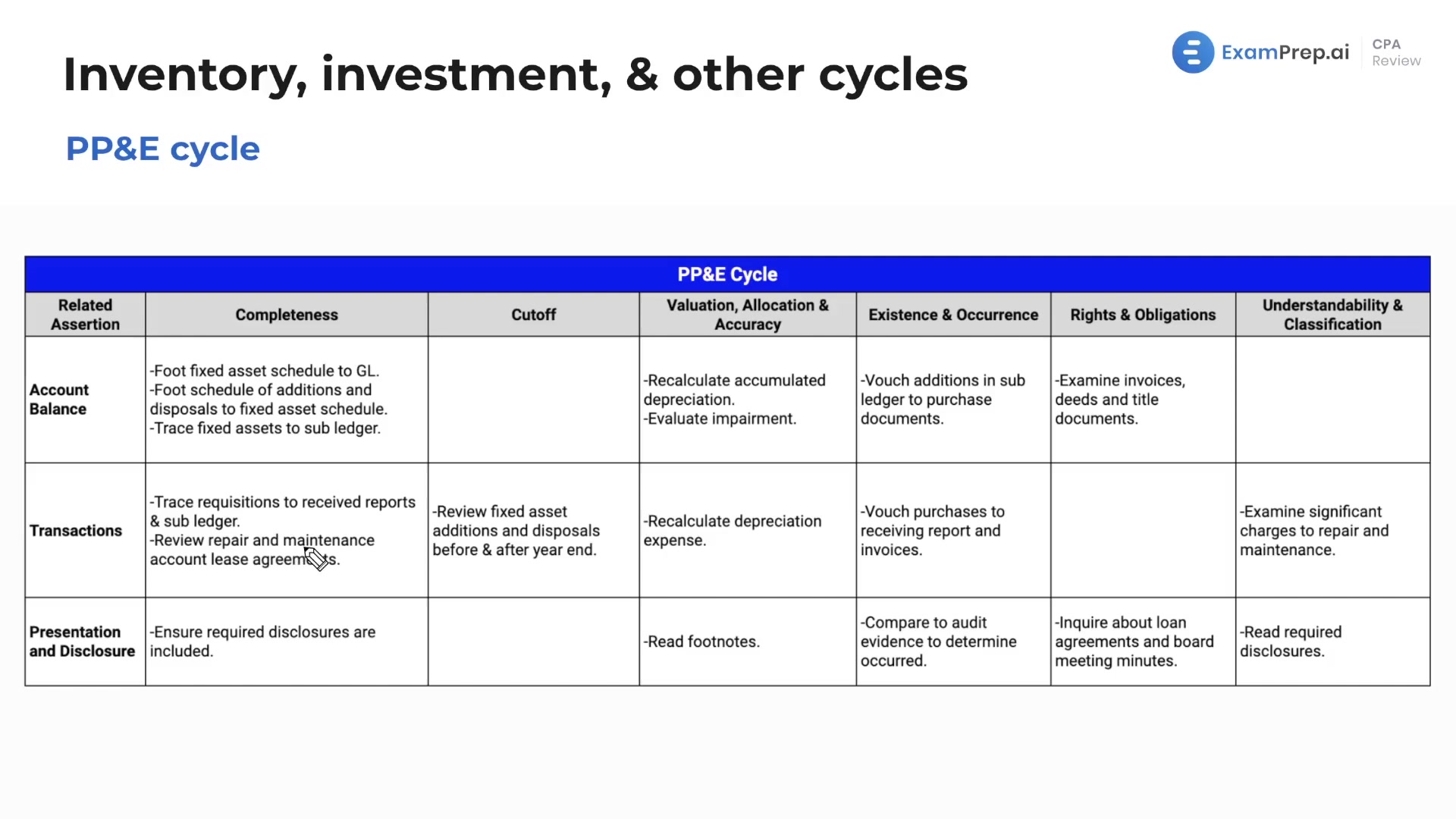

This lesson addresses the property, plant, and equipment cycle and its connection to auditing procedures that deal with assertions like account balance, transactions, and presentation and disclosure. Nick Palazzolo, CPA, teaches how to verify completeness by tying fixed asset schedules together and trace fixed assets to sub-ledgers. The lesson also covers how to evaluate and allocate by recalculating the accumulated depreciation and assessing impairments. Additionally, the lesson details how to test for existence and occurrence, rights and obligations, and the various transactions related to fixed assets. Lastly, Nick presents methods to ensure appropriate presentation and disclosure, which includes reading footnotes and assessing them for material misstatements.

This video and the rest on this topic are available with any paid plan.

See Pricing