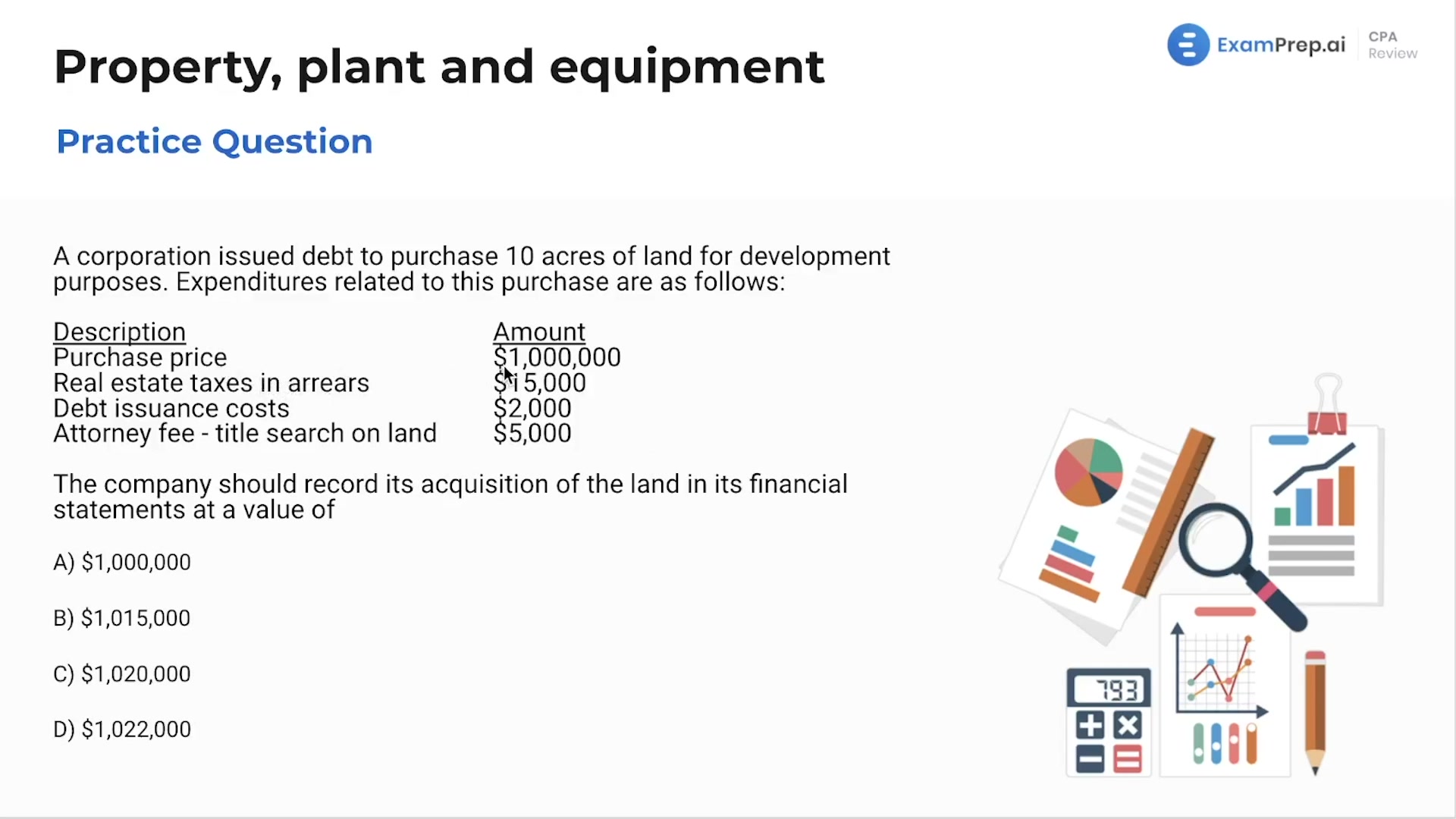

In this lesson, Nick Palazzolo, CPA, delves into Property, Plant, and Equipment (PP&E), tackling a couple of practice questions to solidify the understanding of depreciation and capitalization. With a practical approach, Nick breaks down the start date for depreciation expense, emphasizing the significance of the date the asset is placed in service, rather than the purchase order or shipping date. He thoughtfully dissects each component involved in the acquisition of land—from purchase price and arrears in real estate taxes to debt issuance costs and attorney fees—clarifying what should be included in the depreciable base of an asset. Engaging and informative, this lesson empowers with strategies to differentiate between expenses that are capitalized versus those that should be expensed, encouraging the integration of practice to master these concepts.

This video and the rest on this topic are available with any paid plan.

See Pricing