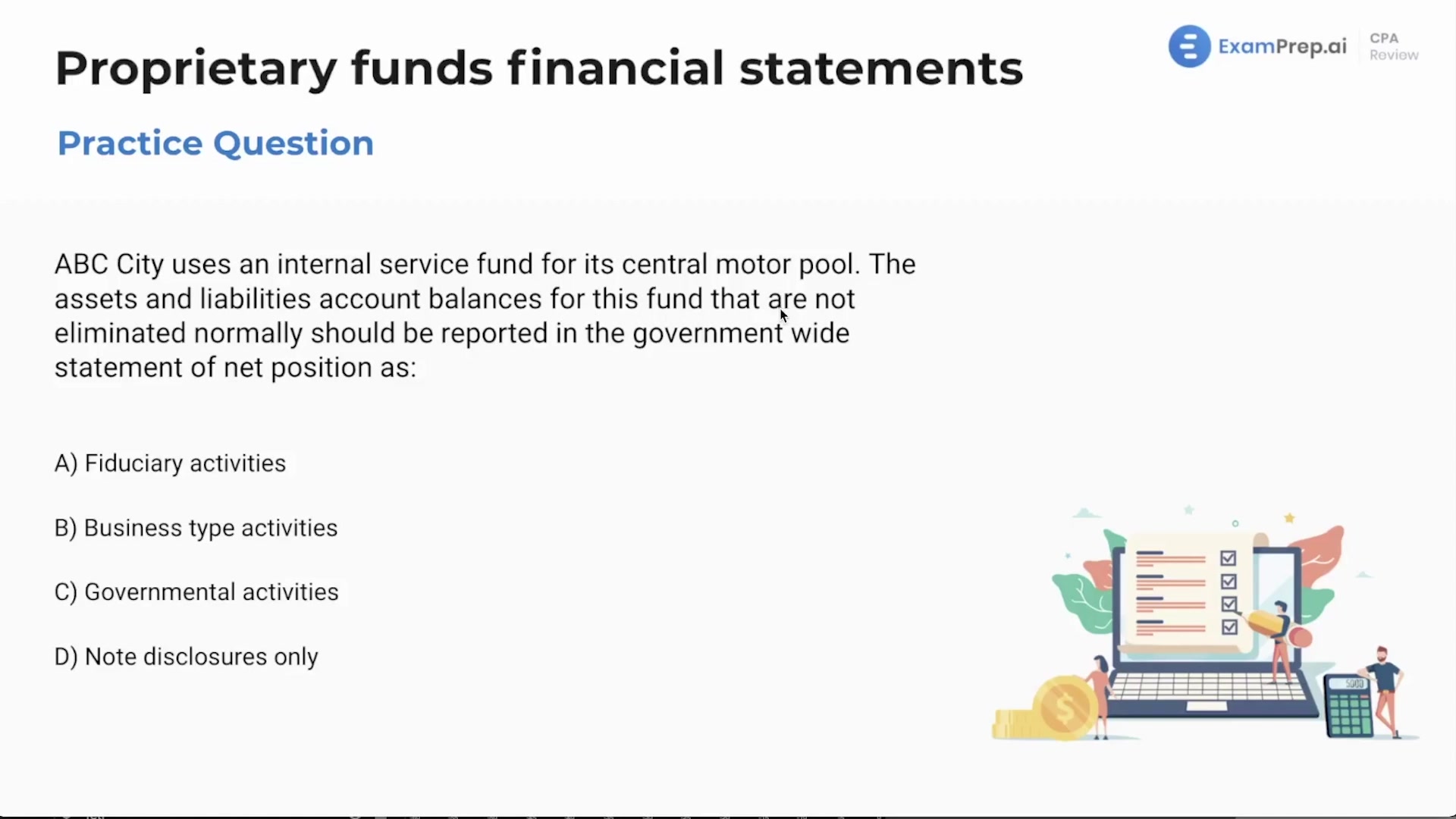

In this engaging lesson, Nick Palazzolo, CPA, dives deep into practice questions on proprietary funds financial statements, focusing on the nuances of enterprise funds within government accounting. He clarifies the distinction between enterprise and internal service funds, guiding through the characteristics that define an enterprise fund, such as the importance of service fees to cover costs including capital costs, rather than reliance on tax revenue. Nick also skillfully navigates through the reporting intricacies for government-wide statement of net positions, providing a crystal-clear explanation for how enterprise and internal service funds appear in consolidated government financial statements. His encouragement to understand financial statements in various sectors underscores the depth of knowledge required to excel in governmental accounting.

This video and the rest on this topic are available with any paid plan.

See Pricing