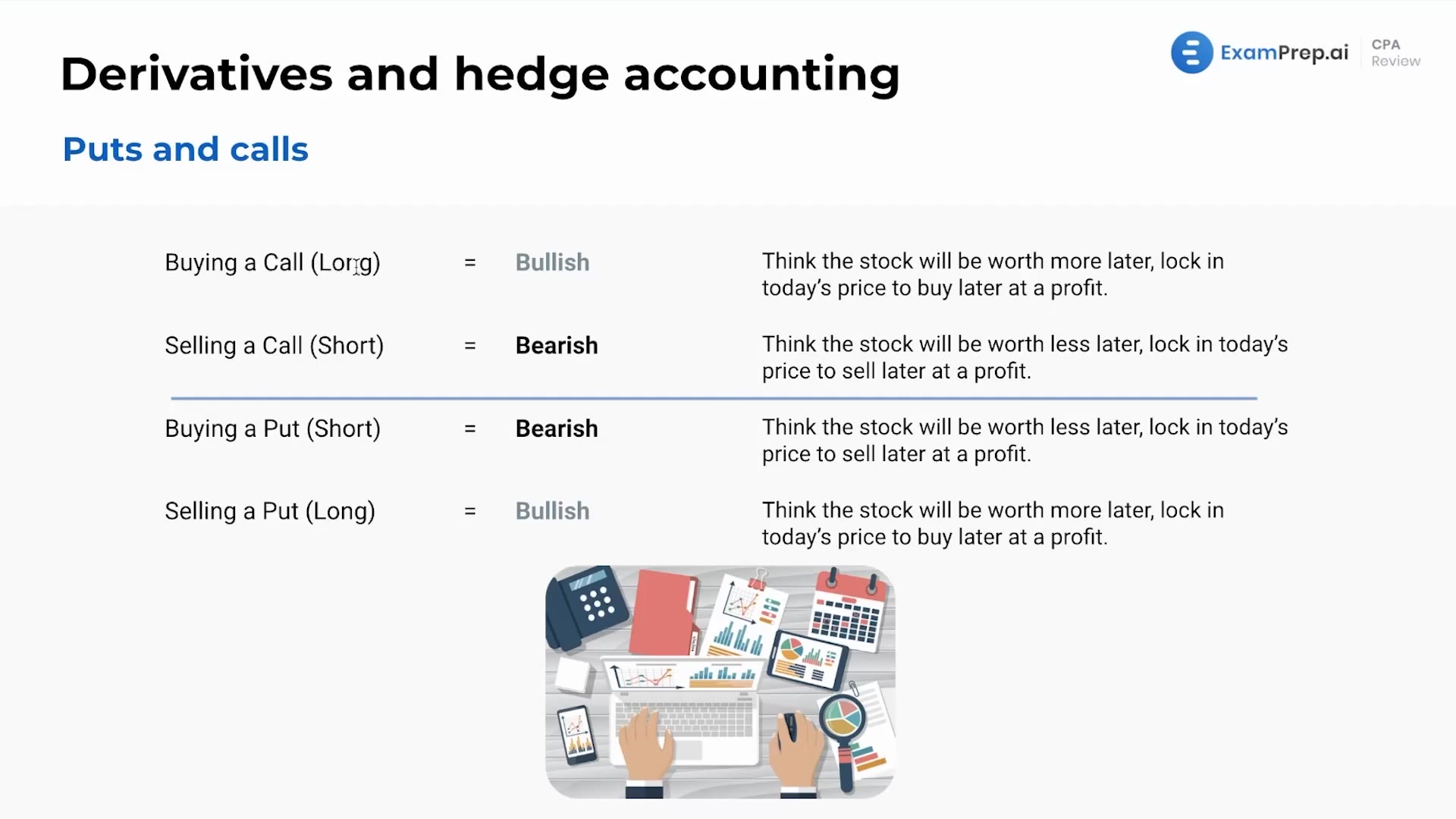

In this lesson, Nick Palazzolo, CPA, demystifies the concepts of puts and calls, critical tools used in the options market. He simplifies these complex financial instruments by likening them to insurance policies and stressing that remembering the directional belief associated with buying each — calls for bullish predictions and puts for bearish expectations — is key. Nick reassures that while understanding the basic principles is necessary, there's no need to overcomplicate the preparation for these topics. He also covers the role of premiums in these transactions, and the perspective of both buyers and sellers, providing a clear framework for when and why an individual might engage in selling puts or buying calls.

This video and the rest on this topic are available with any paid plan.

See Pricing