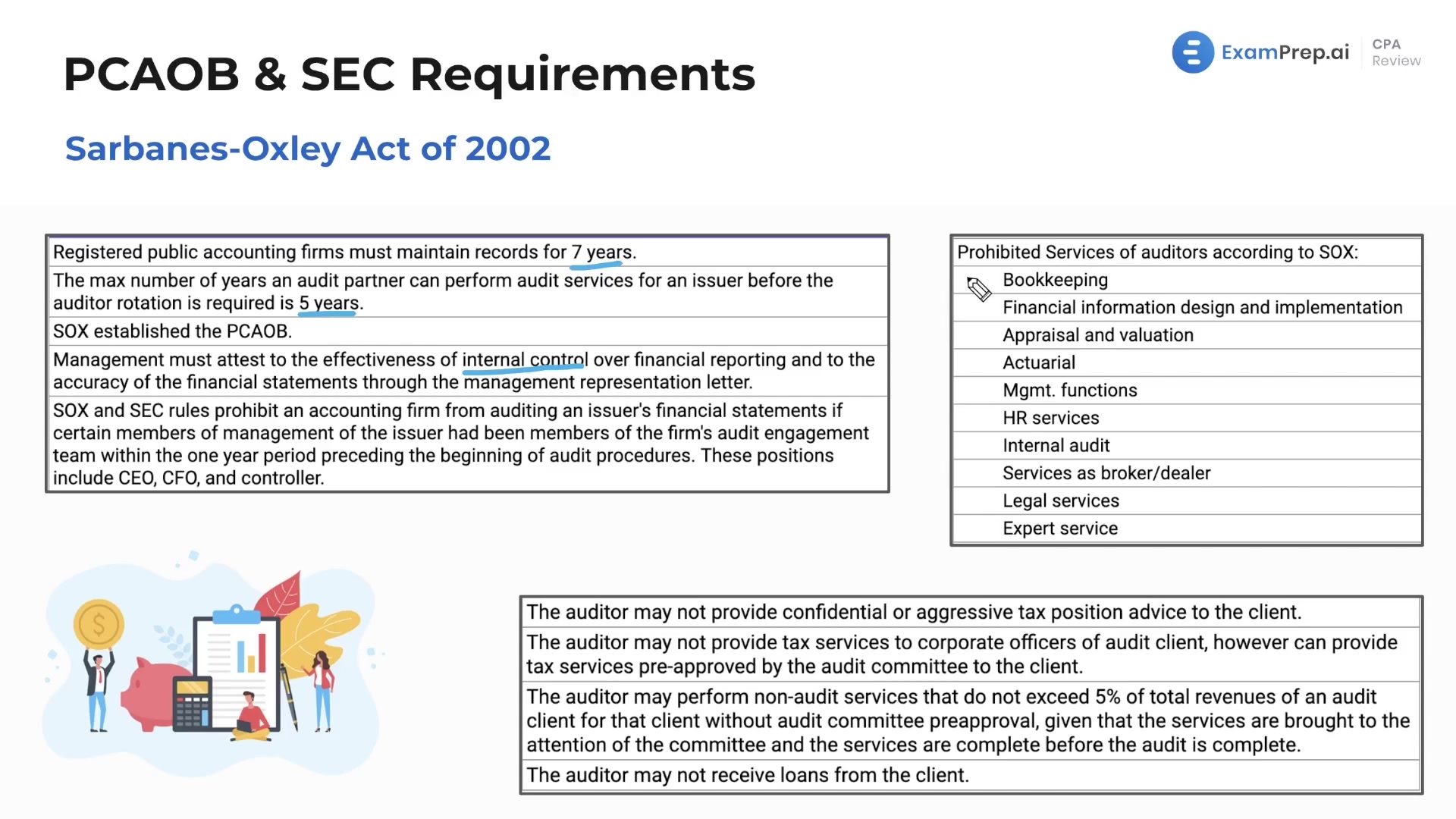

In this lesson, the key aspects of the Sarbanes-Oxley Act of 2002 (SOX) are recapped, focusing on requirements that enhance audit independence. Topics covered include the seven-year record retention requirement for registered public accounting firms, the audit partner rotation rules, and the establishment of the PCAOB. The lesson explains how management must attest the effectiveness of internal control over financial reporting, and highlights the need for a one-year cool-off period before an auditor can join an audit client's management team. The lesson also covers prohibited services that auditors cannot perform according to SOX and the importance of maintaining independence between auditors and their clients. Lastly, the lesson explains the restrictions on non-audit services and receiving loans from audit clients. This lesson helps solidify understanding of the crucial aspects of SOX to ensure compliance and maintain audit independence.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free