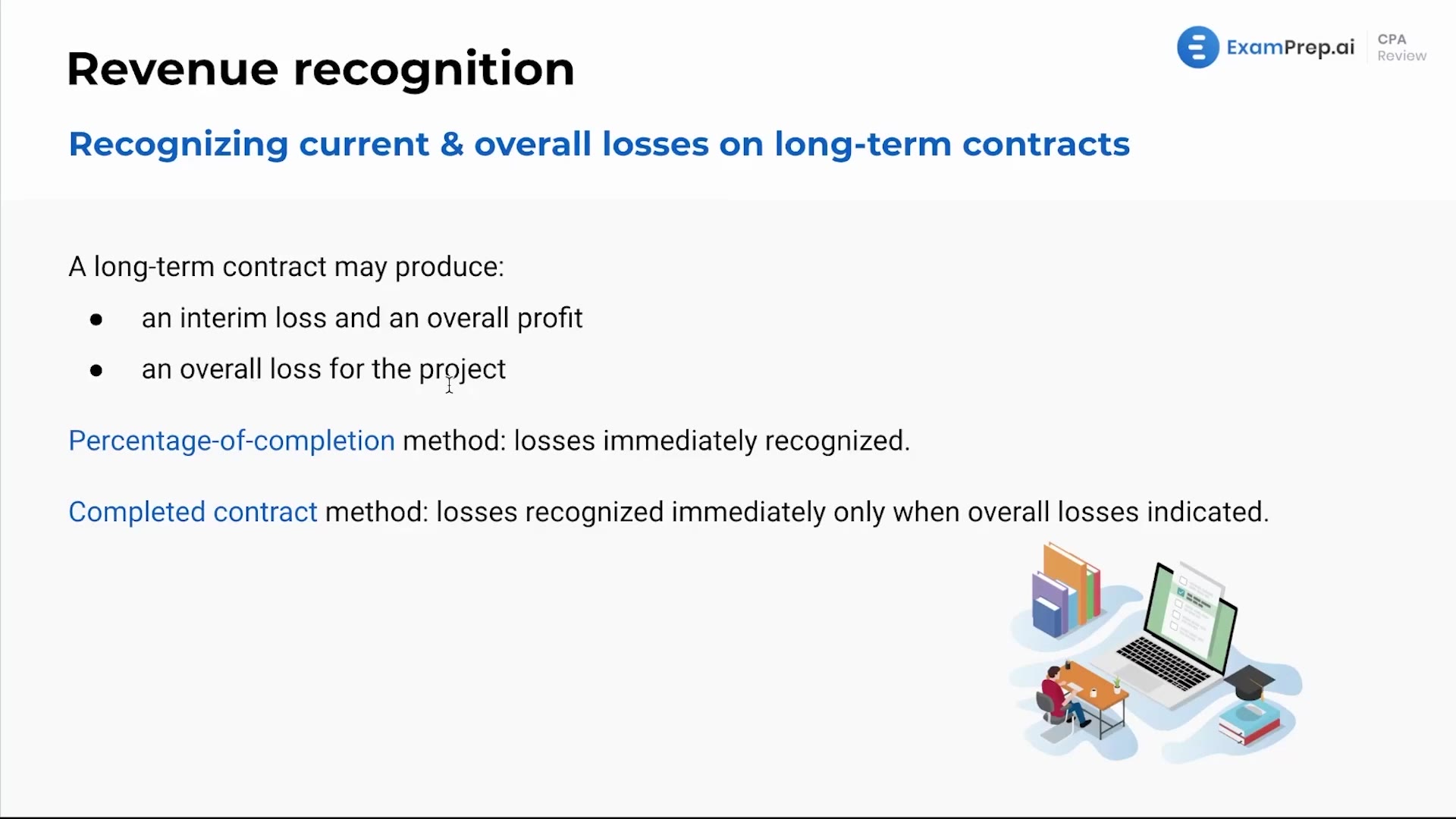

In this lesson, Nick Palazzolo, CPA, tackles the tricky topic of handling losses on long-term contracts. With an engaging and supportive tone, he explains the immediate recognition of losses under the percentage of completion method, highlighting that unlike with profits, losses need to be reported as soon as they're identified to inform financial statement users of the downturn. Nick makes it clearer how to distinguish between interim losses and overall losses, and their different treatments depending on whether the outcome of the project is expected to be profitable or not. He wraps up by comparing the treatment of losses under the percentage of completion and the completed contract methods, ensuring clarity on when and how to recognize losses for both scenarios.

This video and the rest on this topic are available with any paid plan.

See Pricing