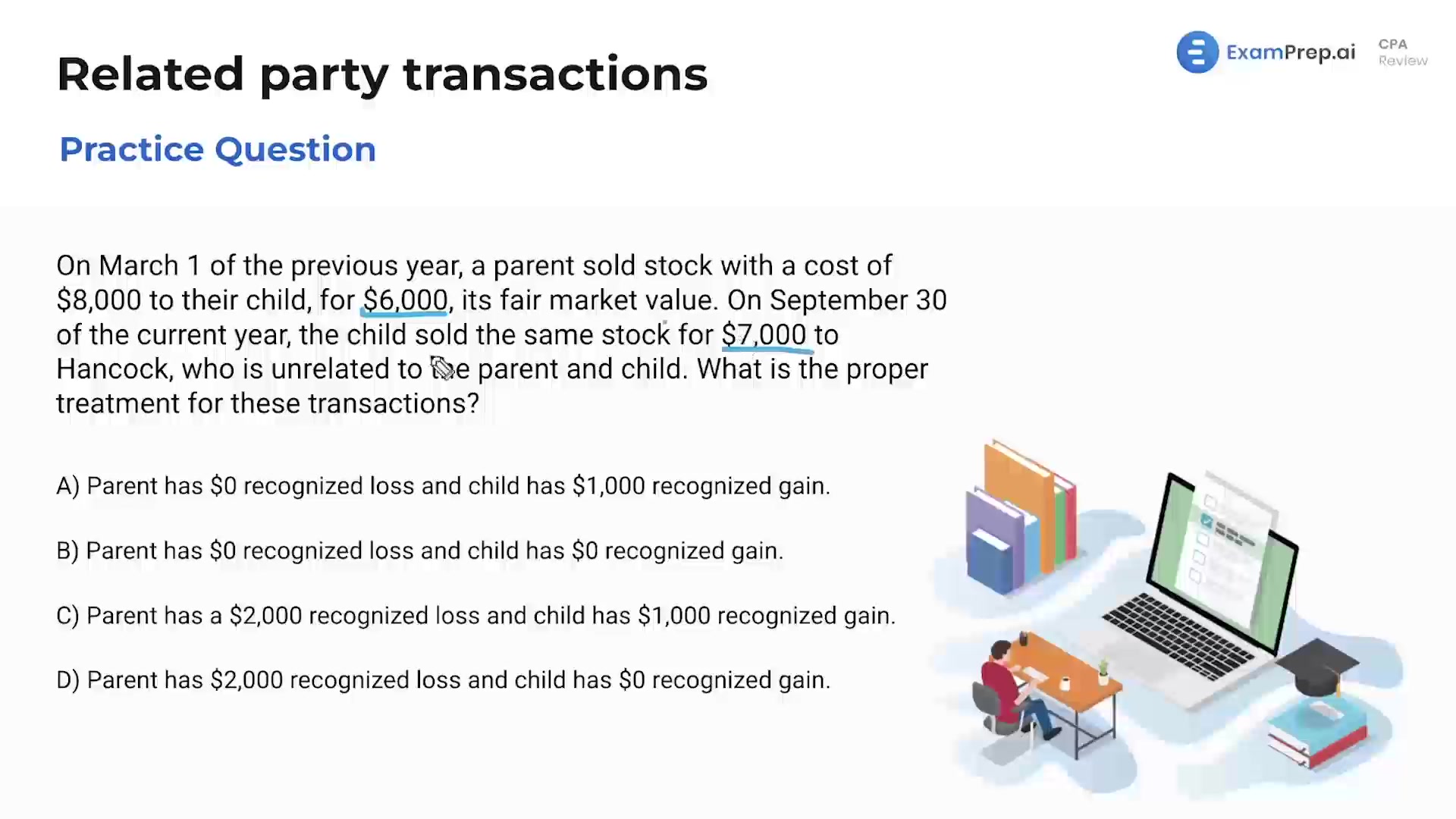

In this lesson, Nick Palazzolo, CPA, dives into the detailed world of related party transactions, guiding you through a series of multiple-choice questions to clarify the intricacies involved. He kicks things off with a scenario where a parent sells stock to a child at a loss, elaborating on the IRS rules that prevent the recognition of such losses for tax purposes. Nick provides a clear breakdown of how these losses are carried forward and the implications for future gains, thoroughly dissecting the logic behind these rules to ensure a complete understanding. Furthermore, he navigates through the complexities of constructive ownership, using an example of family-owned bank stock to shed light on how losses can be considered and disallowed based on stock ownership percentages among family members. It's all about connecting theory to practical examples, making sure the nuances of related party transactions are well understood for anyone tackling this area.

This video and the rest on this topic are available with any paid plan.

See Pricing