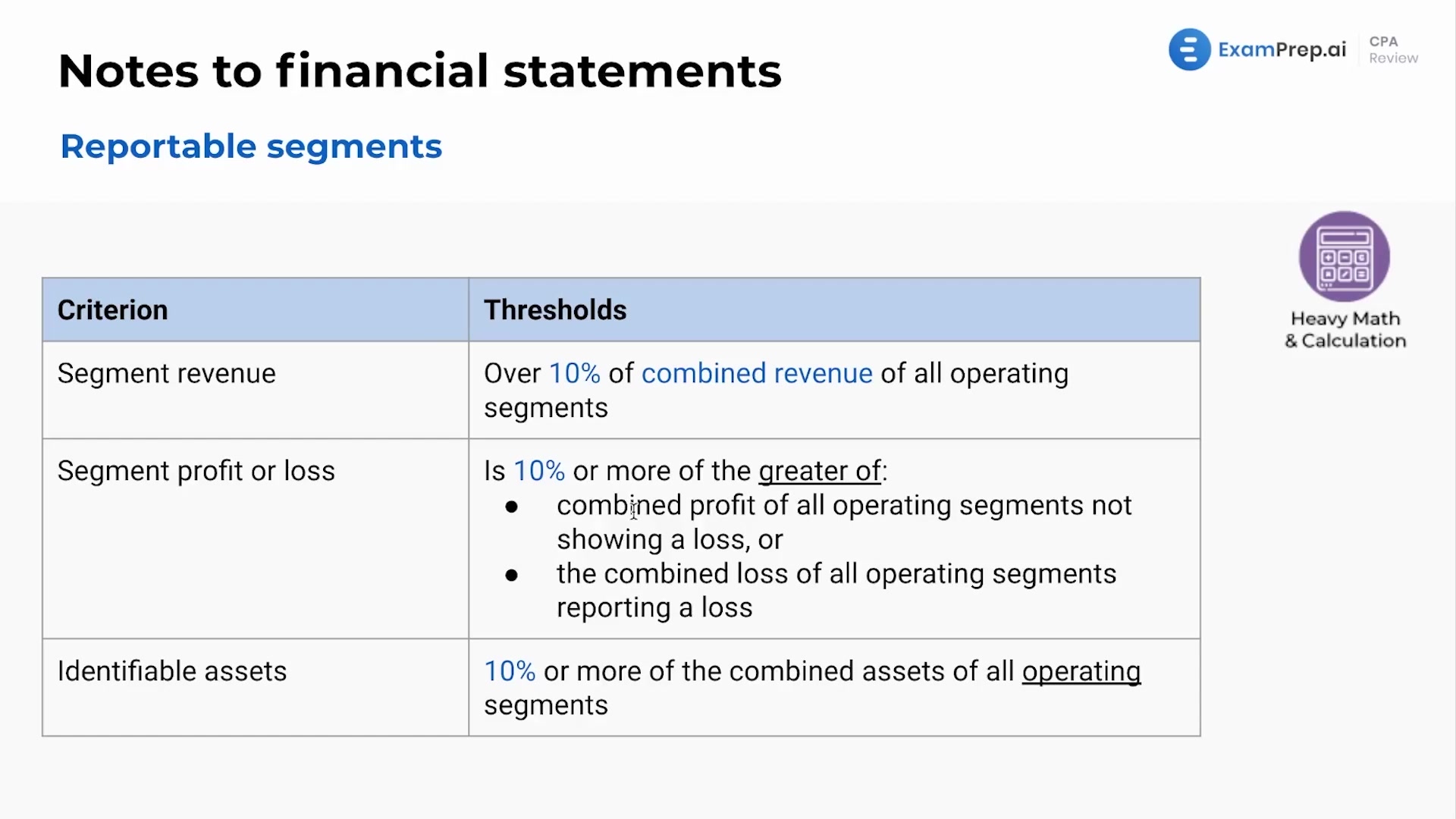

In this lesson, Nick Palazzolo, CPA, unpacks the process of identifying reportable segments for corporate entities like Walmart, guiding you through the essential criteria that determine when an operating segment becomes reportable. He meticulously explains how significant revenue, profit and loss, and the proportion of assets are used to evaluate if an operating segment should be recognized separately. Using practical examples, Nick illustrates the thresholds that necessitate such reporting and delves into the details of what required segment information should be disclosed, which includes general segment details, profit and loss data, asset and liability reconciliation, as well as information on products, services, geographical areas, and major customers. This lesson ensures clarity on how to approach segment reporting and the nuances associated with it.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free