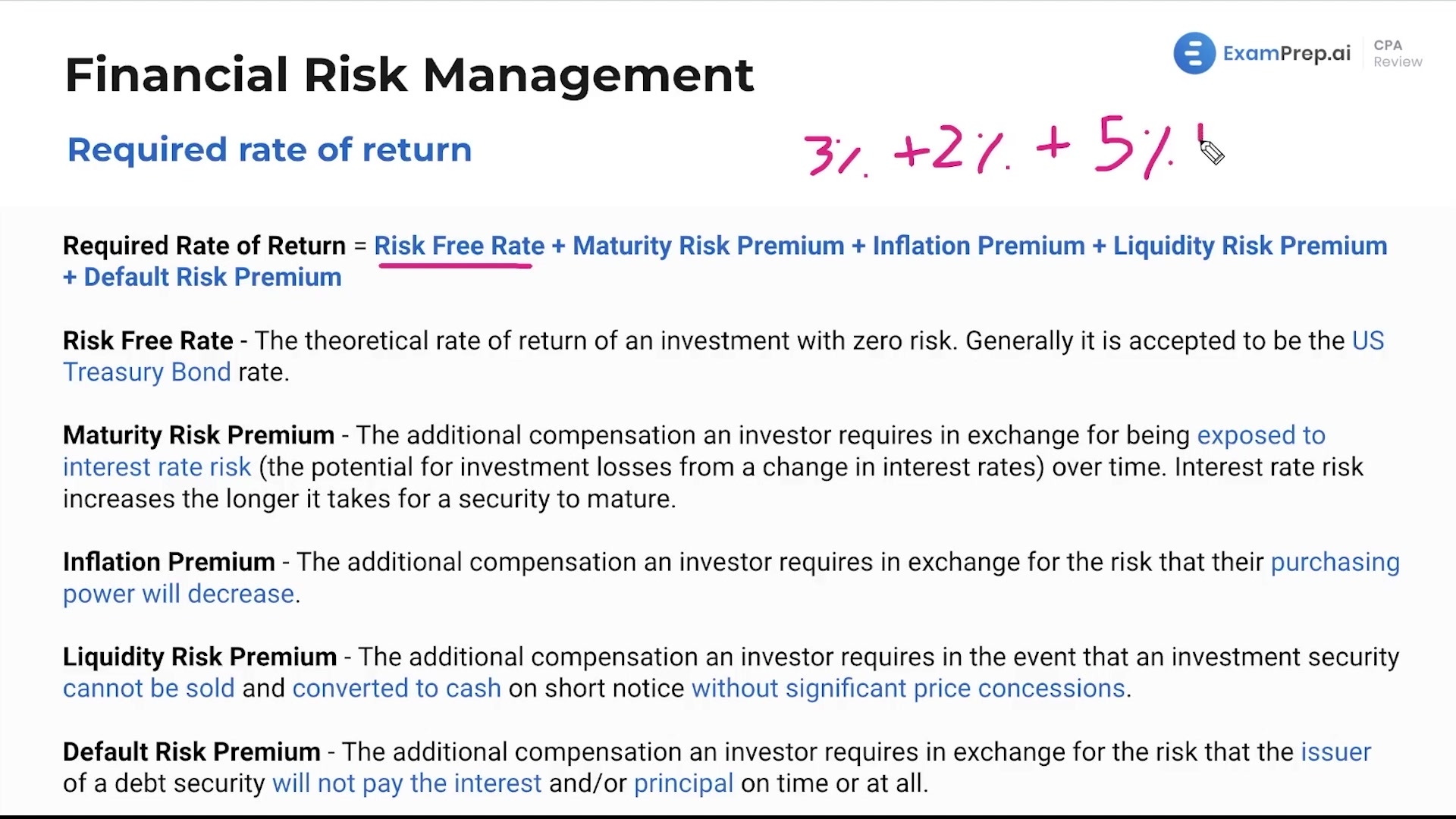

In this lesson, grasp the intricacies of the required rate of return with Nick Palazzolo, CPA, as he delves into how companies like Nike evaluate new projects. This rate isn't just a number pulled from thin air; it's composed of various components, including the risk-free rate, maturity risk premium, inflation considerations, liquidity risk premium, and the default risk premium, topped with the company's own benchmark return rate. Nick walks through each element, explaining their significance and how they combine to form the threshold that determines whether a project is financially viable. By the end of the lesson, the concept of the required rate of return is demystified, providing a clear benchmark for accepting or rejecting potential business ventures based on their ability to exceed this crucial threshold.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free