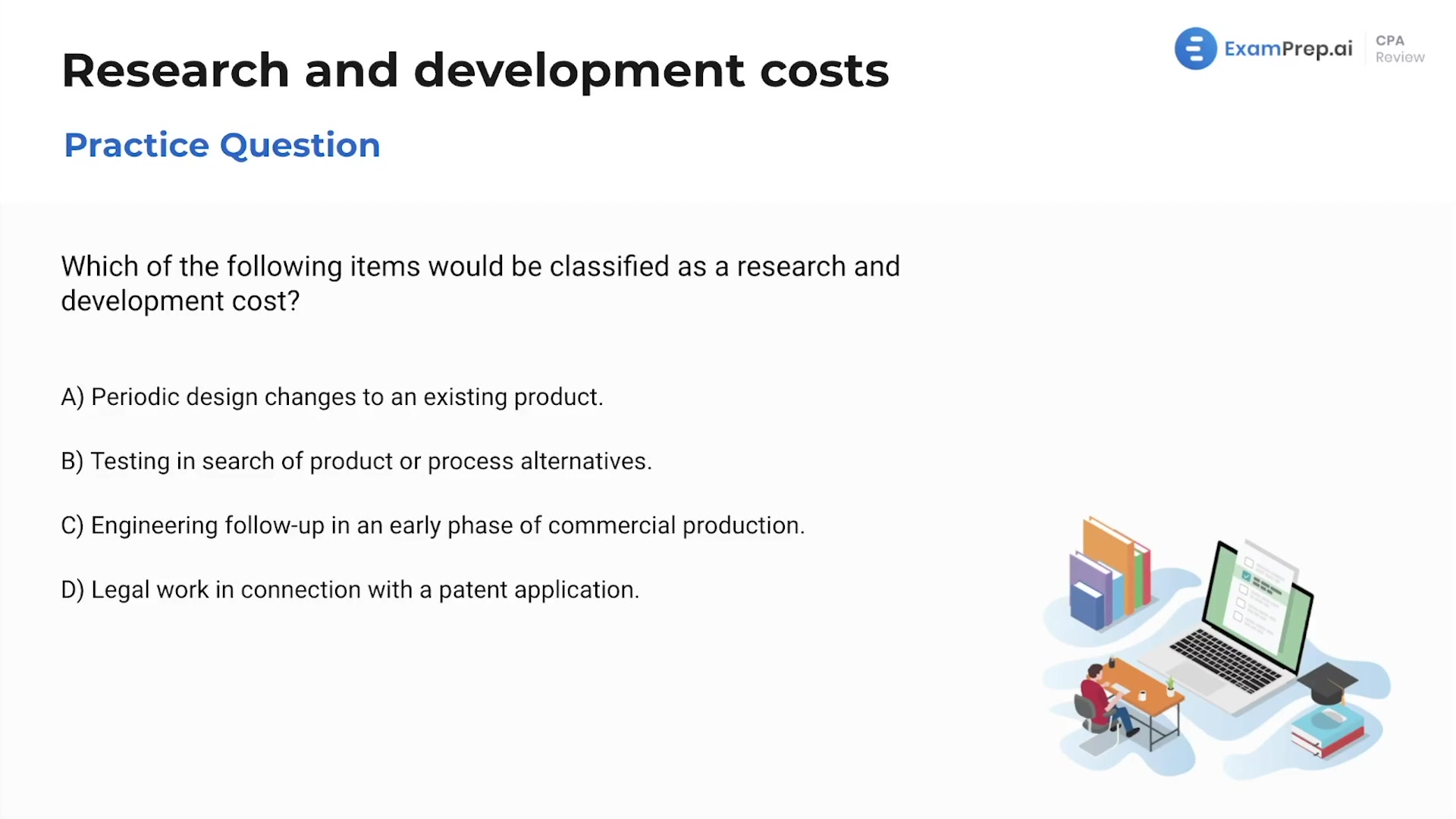

In this insightful lesson, Nick Palazzolo, CPA, dives into practice questions focusing on research and development (R&D) costs. He cleverly implements a straightforward chart to distinguish between when such costs should be expensed and when they should be capitalized. For anyone tangled up in the tricky topics of R&D, Nick makes it simple by associating stages before technological feasibility with expenses and stages afterward with capitalization. He also provides the rationale for eliminating incorrect multiple-choice answers by interpreting the nuances of tax-related answer choices and connects these principles to practical examples, such as periodic design changes or patent-related legal work. By the end of the session, anyone watching will be better equipped to navigate questions related to R&D costs with confidence and clarity.

This video and the rest on this topic are available with any paid plan.

See Pricing