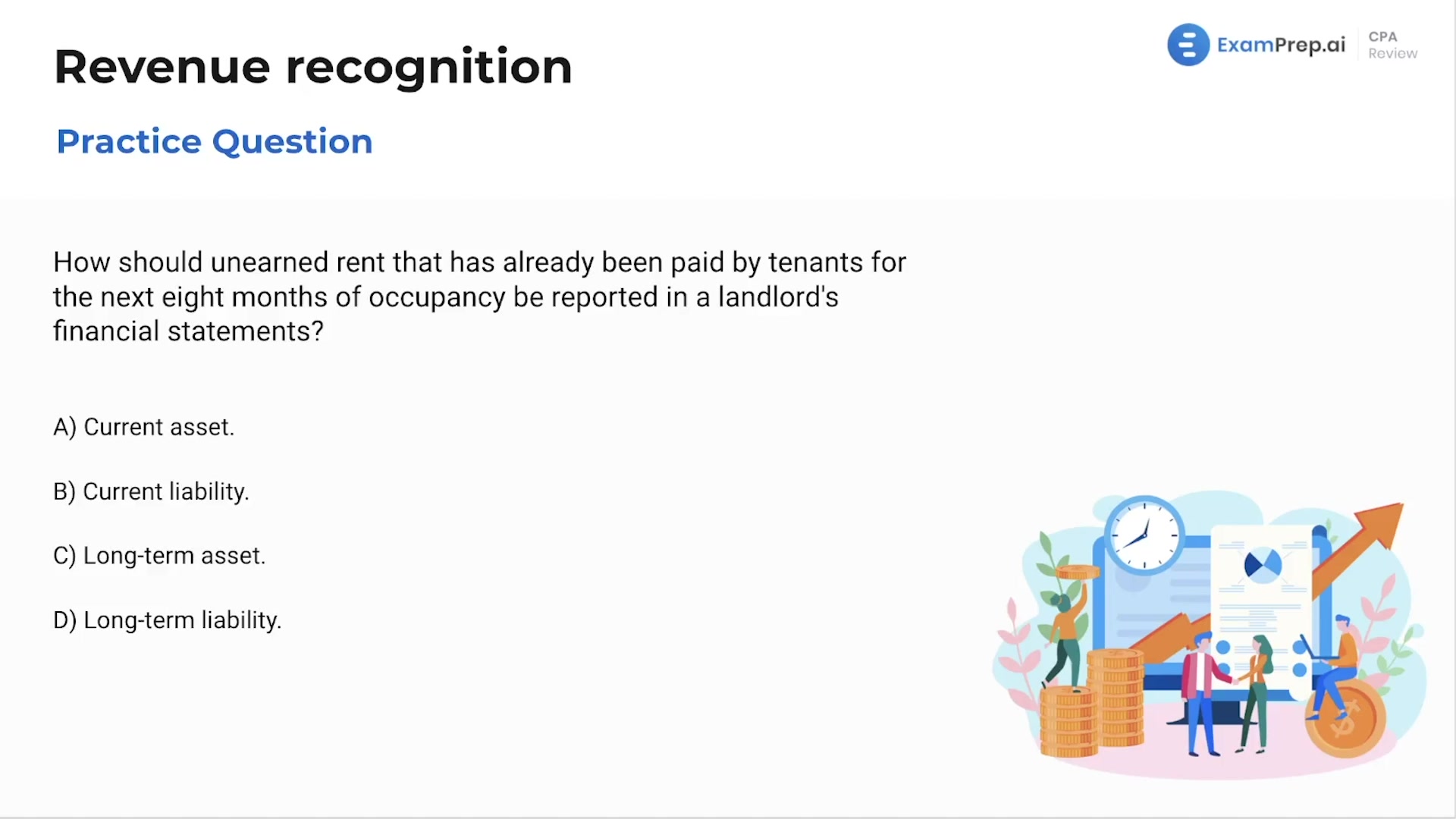

In this lesson, Nick Palazzolo, CPA, tackles the pivotal topic of revenue recognition with a series of practical multiple choice questions. He clarifies that under the accrual basis, which is pertinent for the FAR exam, revenue is recognized not when it is received or pledged, but when it is truly earned. Nick debunks common misconceptions and solidifies the "revenue is recognized when earned" concept as a mantra. He further examines how unearned rent should be reported in financial statements, stressing the importance of understanding current liabilities in relation to prepaid services. His approach makes navigating these core principles more accessible, engaging with examples that resonate with real-world accounting scenarios. The session wraps up with motivational advice, encouraging a mindful balance between studying and self-care to maintain momentum.

This video and the rest on this topic are available with any paid plan.

See Pricing