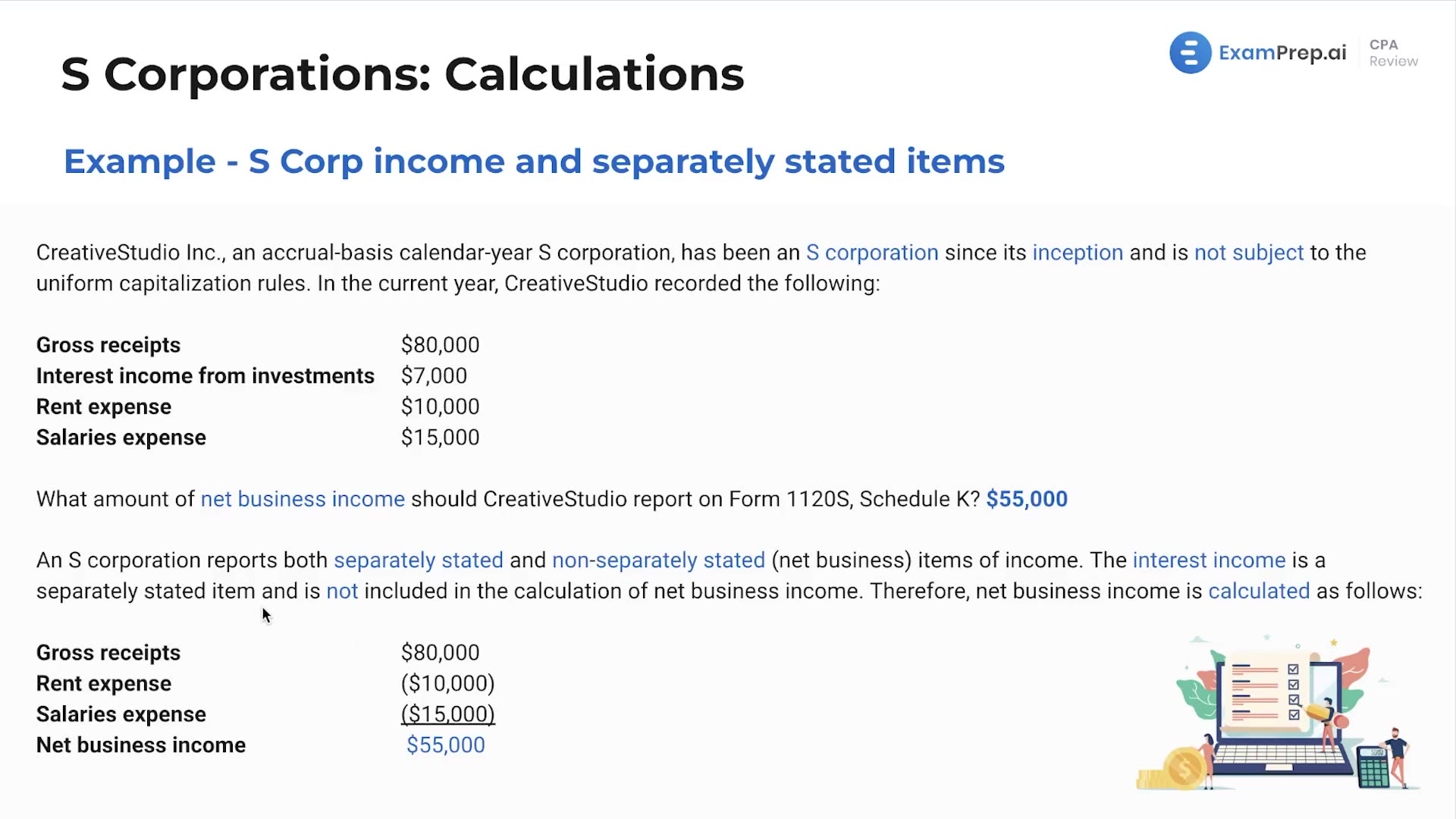

In this lesson, Nick Palazzolo, CPA, breaks down the complexities of S Corporation income, emphasizing the distinction between separately stated items and those that are not separately stated. Using the example of Creative Studio Inc., Nick explains how to determine the net business income for an S Corporation's tax return, illustrating the process by categorizing business transactions. He highlights why certain items, such as interest income, are considered separate and the impact they have when calculating the company's ordinary income. Wrapping it up, Nick reminds everyone of the importance of diligent practice with practice questions and simulations to master the concepts covered.

This video and the rest on this topic are available with any paid plan.

See Pricing