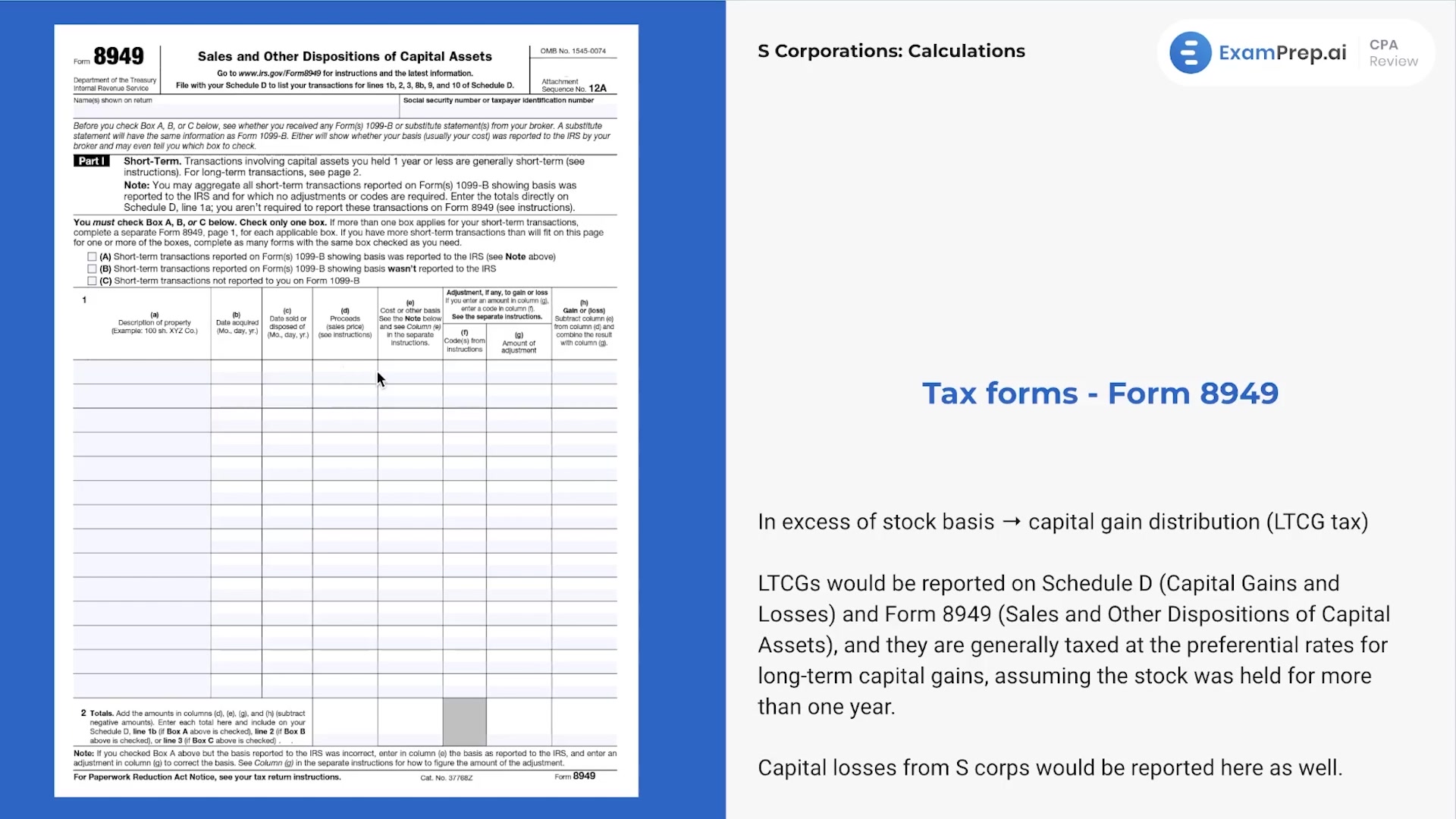

In this lesson, Nick Palazzolo, CPA, takes a deep dive into the intricate world of tax forms relevant to S corporations. With a lively approach, Nick educates on how to navigate key forms such as form 1040 Schedule B and form 8949, stressing the importance of understanding where different types of income should be reported. Covered under his guidance is the flow of information from the sale and disposition of capital assets to dividends received from a C corporation, and how these affect the tax returns. He emphasizes the value in comprehending the flow-through onto a taxpayer's 1040 form, which can aid in both exam success and real-world tax filing. Nick's practical advice and humorous touches help simplify the complexity of S Corporation tax reporting and make it accessible.

This video and the rest on this topic are available with any paid plan.

See Pricing