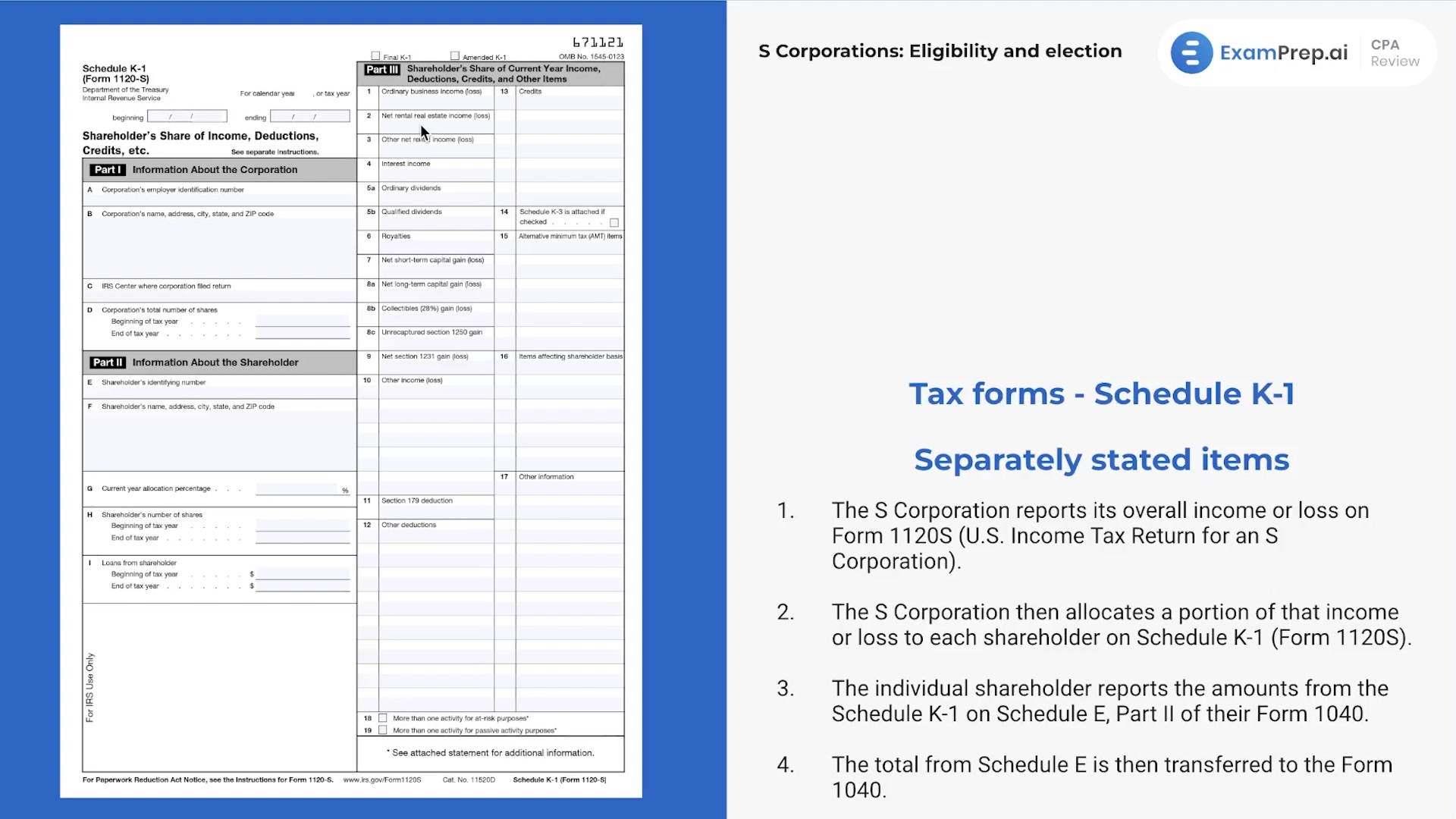

In this lesson, Nick Palazzolo, CPA, demystifies the intricate world of S Corporation tax forms by breaking down the key components and demonstrating how they interconnect. With a focus on the 1120S, including its critical first page, Nick illustrates how income, losses, deductions, and credits are reported and flow through the S Corporation's tax return. He emphasizes the importance of understanding Schedule K and K-1, as they are vital for allocating shares of income or loss to the shareholders. Nick also explains how this information transitions to an individual's tax return, guiding through Schedules E and 1 of the 1040 form, and how such items influence their tax liability. Additionally, he makes connections between S Corp taxation and partnership taxation, crucial for grasping concepts that cross over between the two entities. This lesson provides a clear roadmap for navigating S Corporation tax forms and their implications.

This video and the rest on this topic are available with any paid plan.

See Pricing