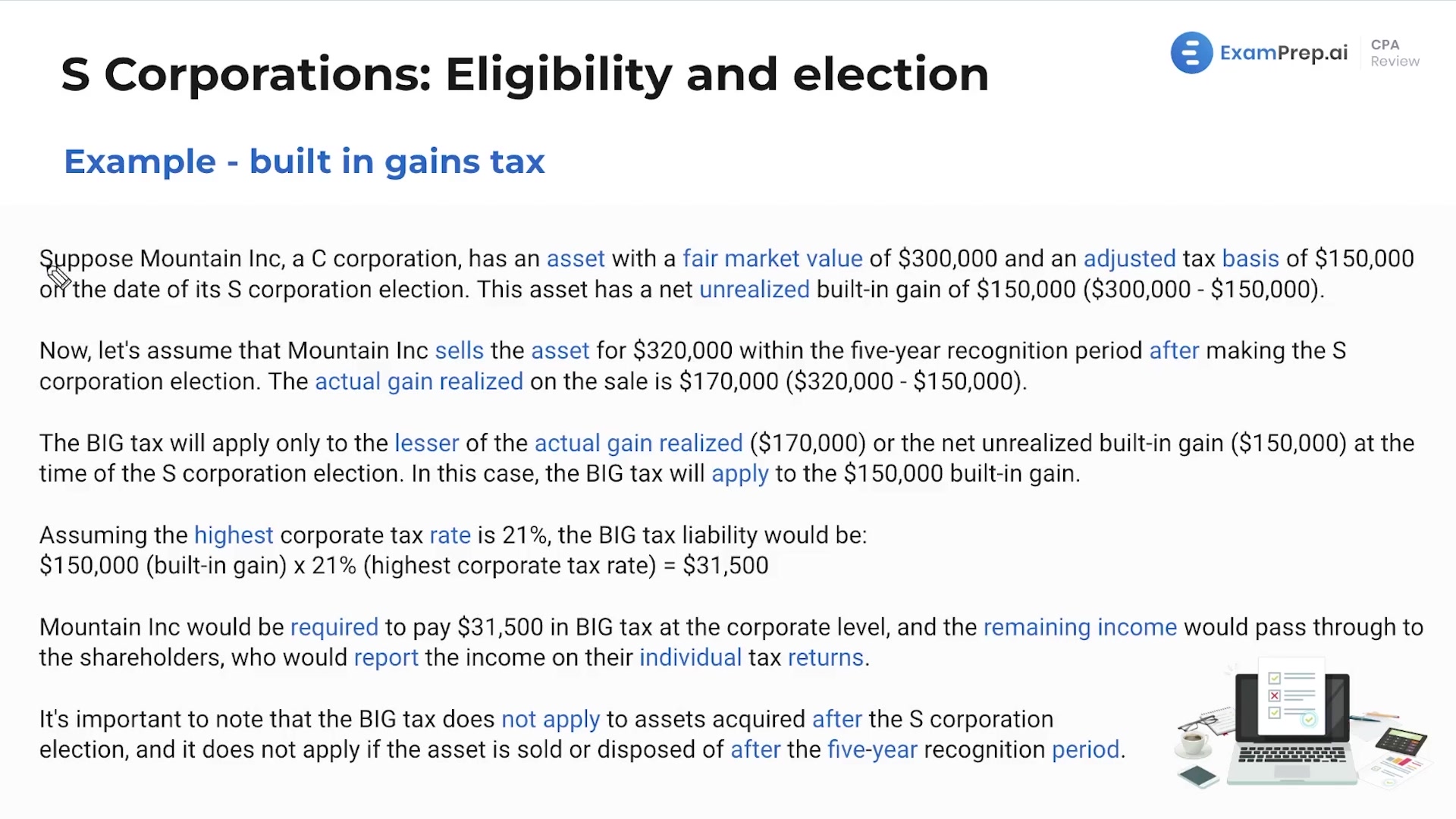

In this lesson, Nick Palazzolo, CPA, dives into the intricacies of the built-in gains tax, explaining its importance for corporations converting from C to S status. He demystifies this provision as a countermeasure by the IRS to prevent C-corporations from skirting around the double taxation system by becoming S-corporations. With his signature practical approach, Nick employs an illustrative example to clarify how the tax applies to appreciated assets during the C-corp phase and articulates its implications within the five-year recognition period post-election. He ensures that the potential tax liabilities are made crystal clear, detailing the tax rates and the specific calculation methods that highlight the tax’s impact. Understanding this concept is pivotal because it influences the strategic planning around asset disposition for businesses contemplating or having undergone a taxation status change.

This video and the rest on this topic are available with any paid plan.

See Pricing