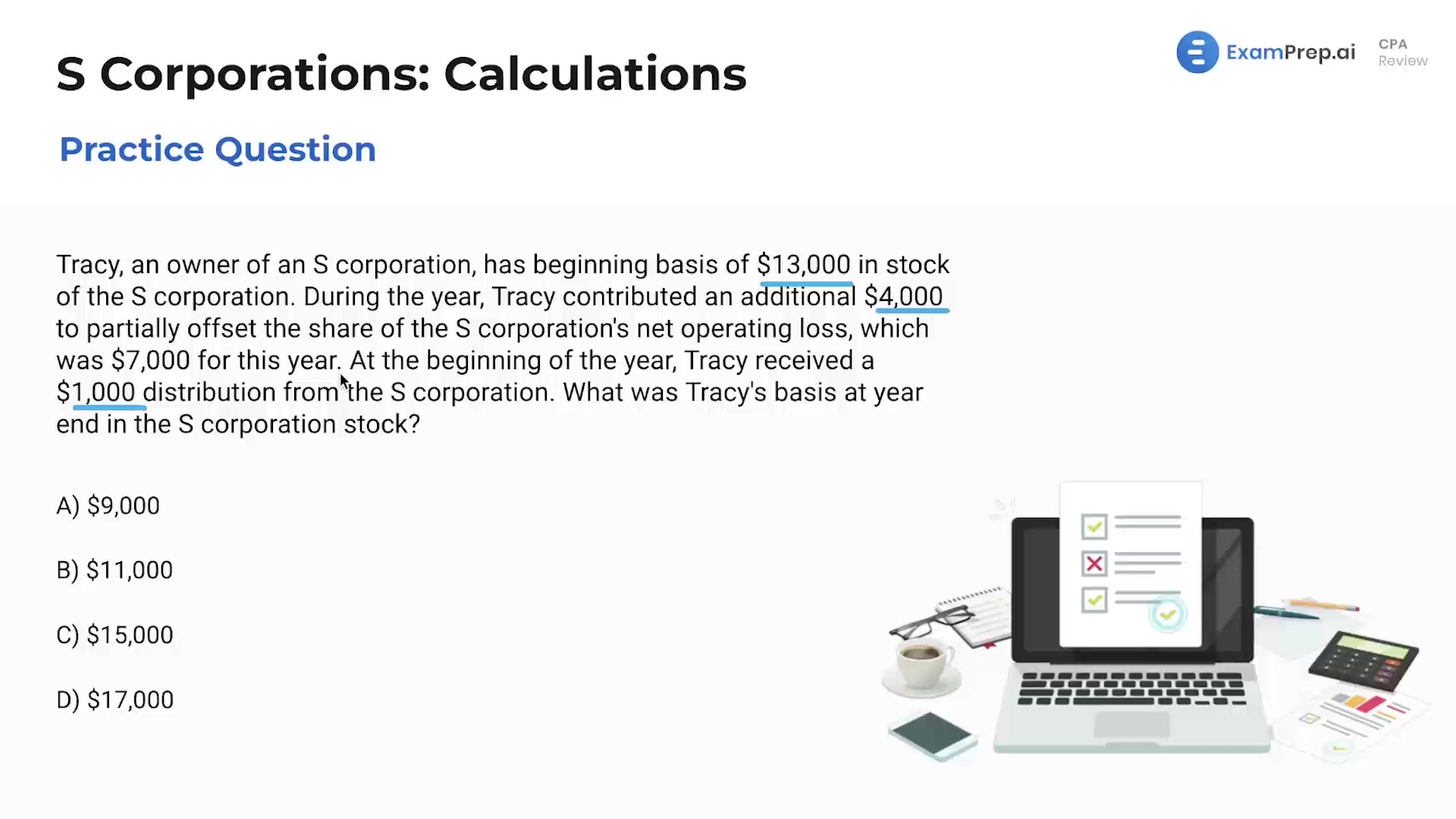

In this lesson, follow along with Nick Palazzolo, CPA, as he demystifies the nuances of S Corporation tax basis calculations through a series of comprehensive practice questions. Nick provides clear-cut explanations on how various S Corp activities—like contributions, distributions, and allocations of income and loss—affect an owner's basis in the company. The approach adopted here is practical and hands-on, with Nick illustrating the step-by-step process of basis calculations, emphasizing key considerations such as beginning basis, additional contributions, loss deductions, and distributions. By the end of this engaging lesson, the seemingly complex world of S Corporation basis adjustments will be unraveled, providing a solid understanding of how to determine a shareholder's year-end tax basis.

This video and the rest on this topic are available with any paid plan.

See Pricing