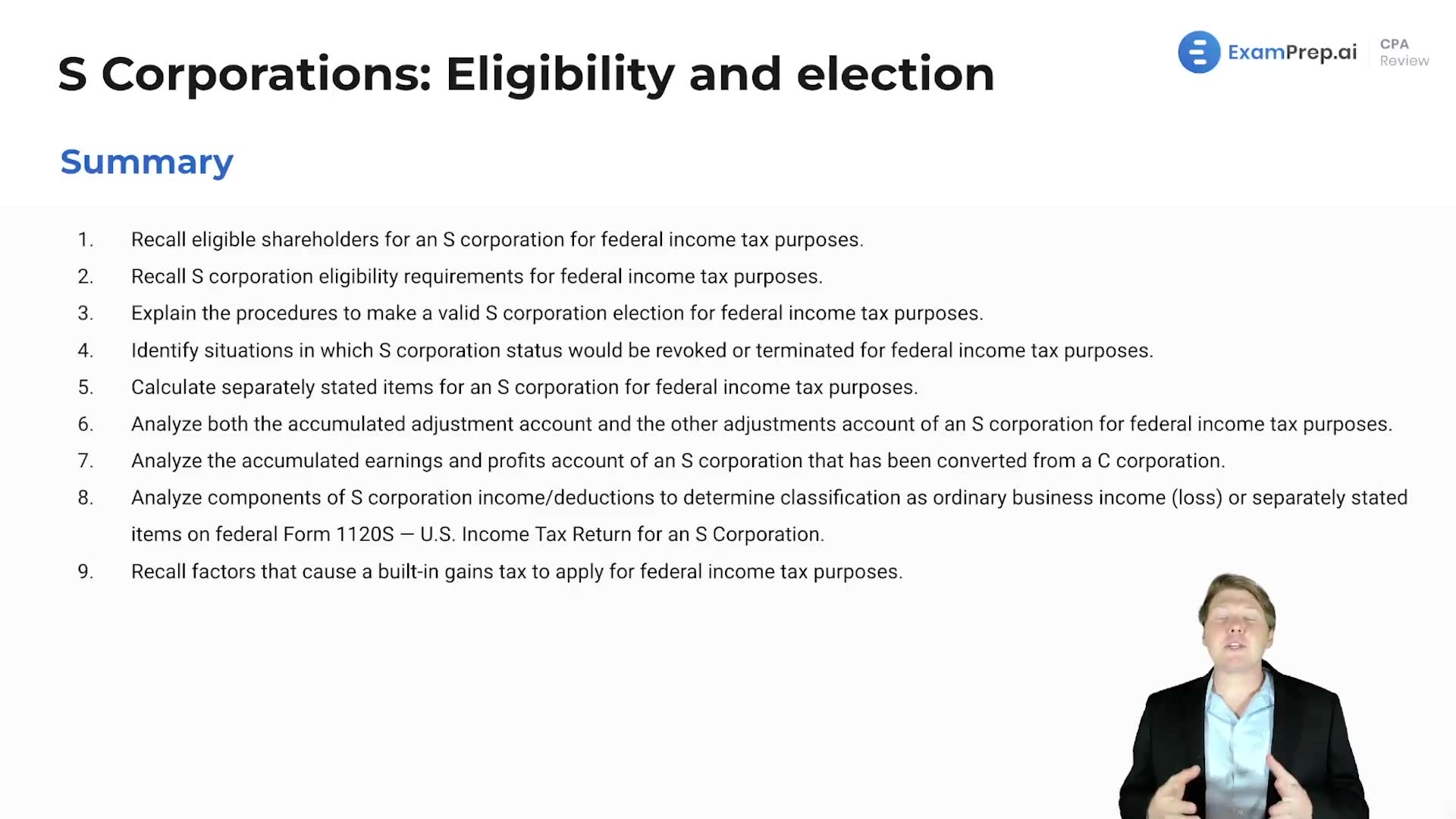

In this lesson, Nick Palazzolo, CPA, wraps up the discussion on S Corporations with a focus on the intricacies of their eligibility requirements and the election process. Delving beyond the basics, he ensures comprehensive coverage of the characteristics unique to these flow-through entities, which share several similarities with partnerships. He underscores the necessity for a thorough understanding of the process for becoming an S Corporation, recalling the specific thresholds, and recognizing the circumstances that could result in a loss of S Corporation status. With a nod to the relevance of the subject in both multiple-choice questions and simulation examinations, Nick underscores the lesson's importance in mastering the entire S Corporation concept.

This video and the rest on this topic are available with any paid plan.

See Pricing