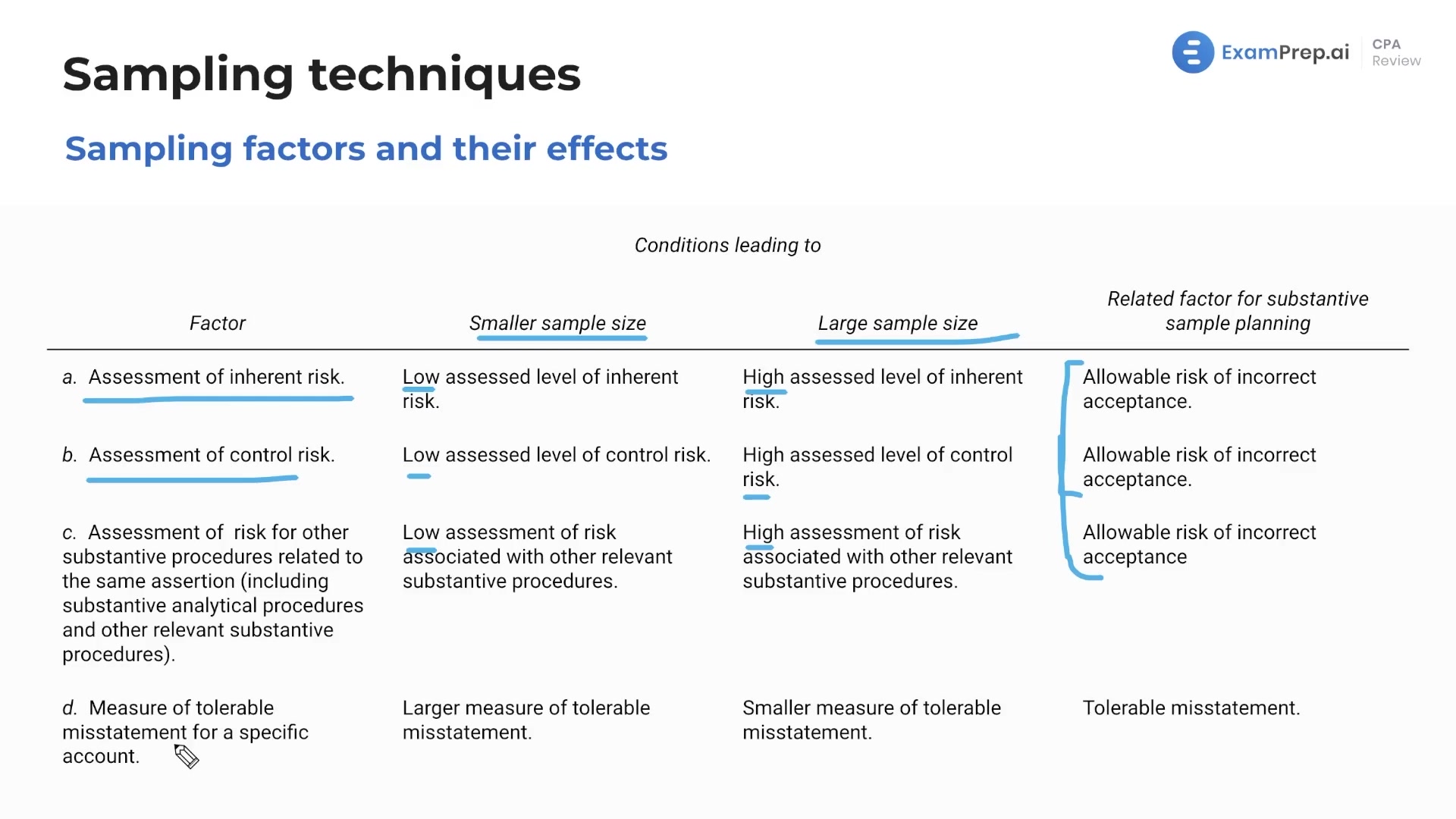

In this lesson, Nick Palazzolo, CPA, discusses the various factors affecting sample size and their impacts on audit sampling. He begins by explaining the assessment of inherent risk and how having a high-risk level leads auditors to choose a larger sample size. He then moves on to discuss substantive sample planning, where allowable risk of incorrect acceptance plays a crucial role. Furthermore, the lesson covers the concept of tolerable misstatement and its relation to sample size selections. Lastly, he talks about expected misstatements and their frequencies and explains how the number of items in the population and the choice between statistical and non-statistical sampling affect the sampling process.

This video and the rest on this topic are available with any paid plan.

See Pricing