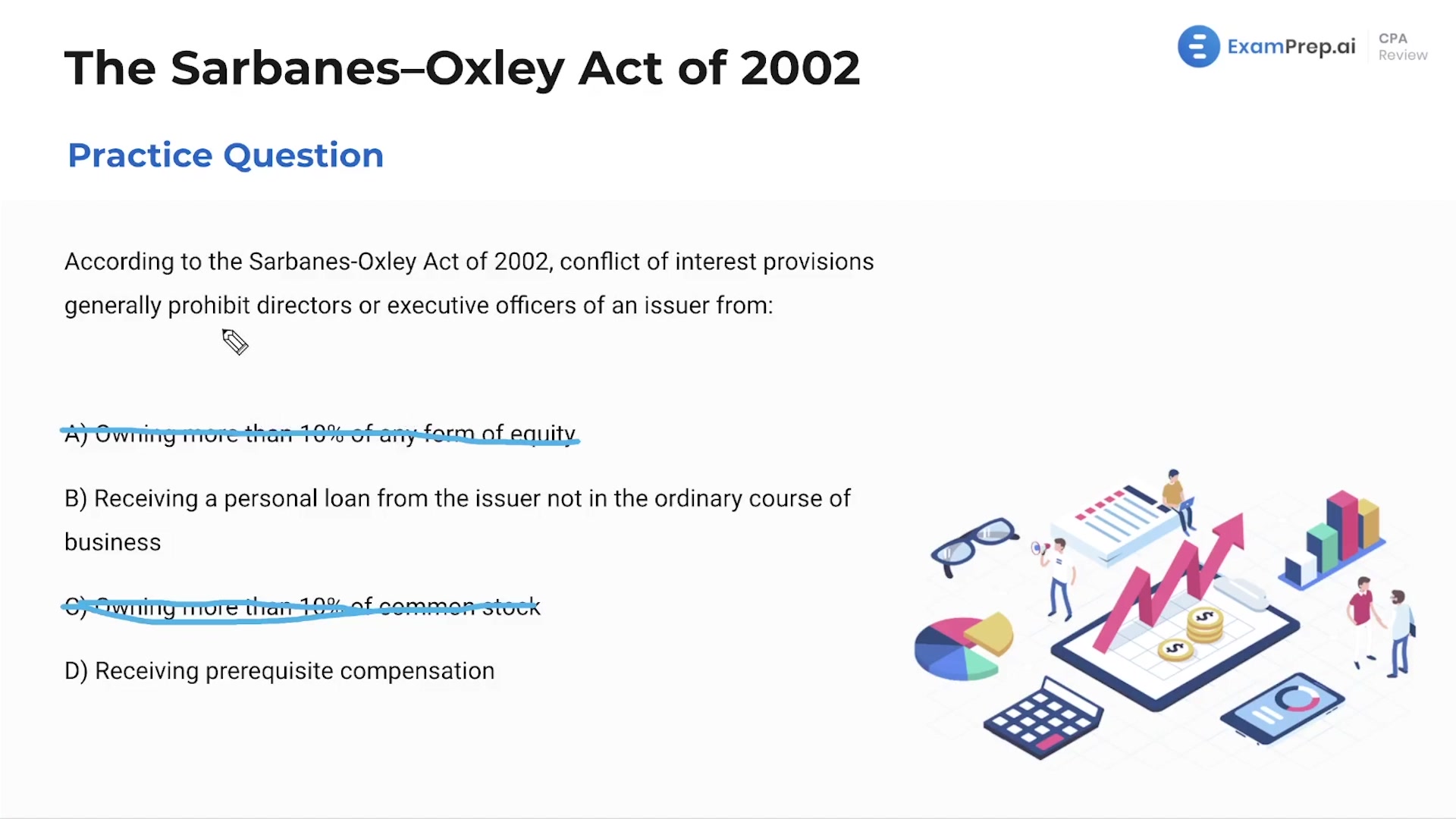

In this lesson, Nick Palazzolo, CPA, dives into the intricacies of the Sarbanes-Oxley Act of 2002 (SOX), focusing on some challenging practice questions that help unravel the details of the act. He emphasizes the severe consequences of fraud and obstruction, noting that it can lead to two decades of imprisonment—a fact worth memorizing. Nick discusses the qualifications required for an audit committee financial expert, outlining why possessing experience with internal accounting controls is crucial. The lesson navigates through the murky waters of conflicts of interest, exploring why personal loans from banks to executives are a no-go, except in ordinary business circumstances. Finally, Nick clarifies the origin and role of the Public Company Accounting Oversight Board (PCAOB), contrasting it with other organizations and placing it in the broader context of audit examinations. This walkthrough not only sharpens understanding of SOX but also provides strategies to tackle memorization-based exam questions.

This video and the rest on this topic are available with any paid plan.

See Pricing