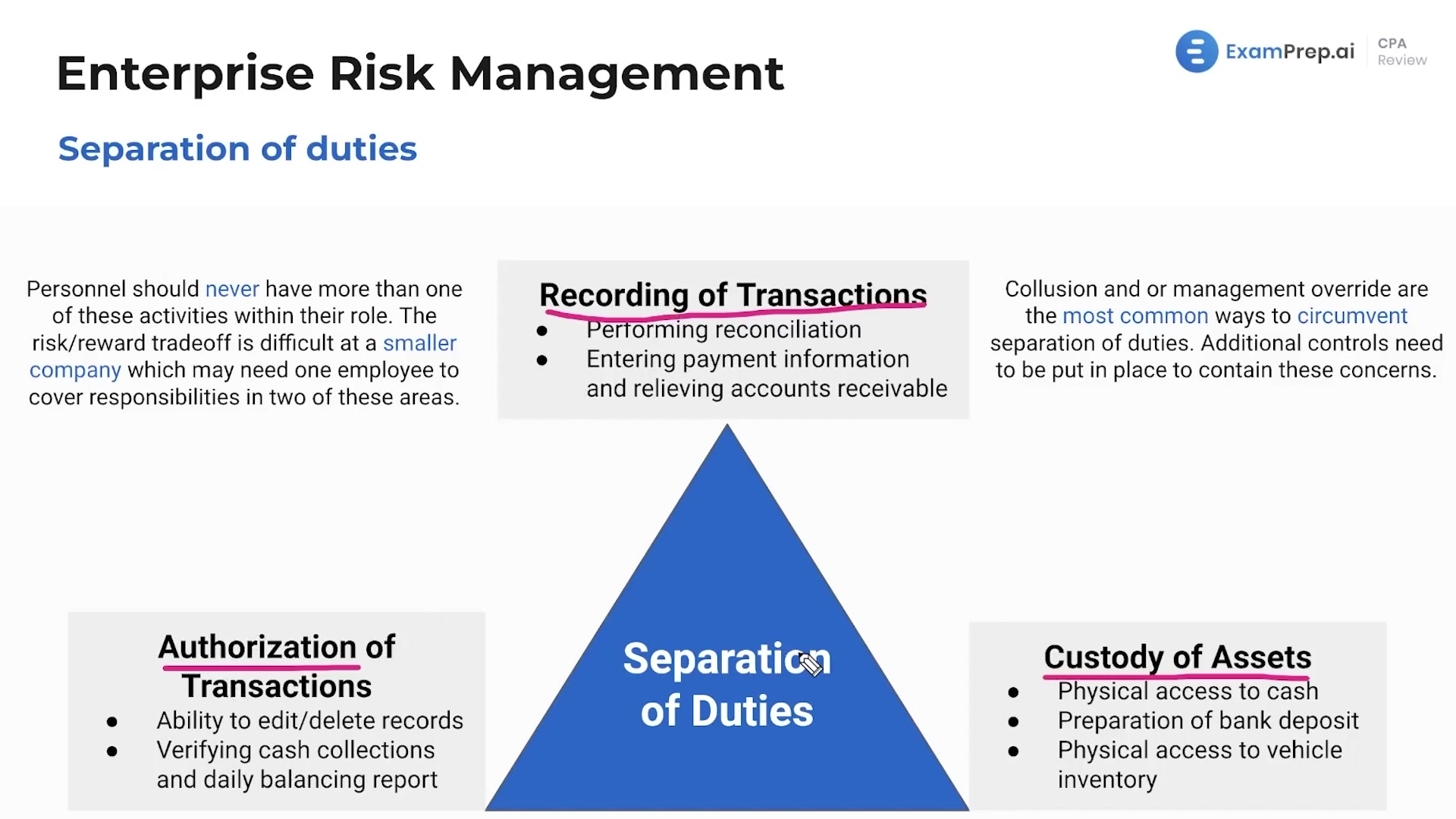

In this lesson, Nick Palazzolo, CPA, breaks down the principles of segregation of duties, an important component of internal controls designed to prevent fraud within organizations. He intricately ties this concept to the fraud triangle—highlighting the roles of incentive, opportunity, and rationalization in potential fraudulent activities. Nick uses Microsoft as a practical example to illustrate the distinct roles required in a company to maintain effective segregation: recording transactions, having custody of assets, and authorizing transactions. He also uncovers how collusion and management override can circumvent these controls, stressing the significance of additional controls, such as mandatory vacations, to detect fraud. Toward the end, Nick discusses the risk-reward trade-off that companies face when deciding whether to hire additional personnel to ensure proper segregation of duties, especially in the context of smaller companies.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free