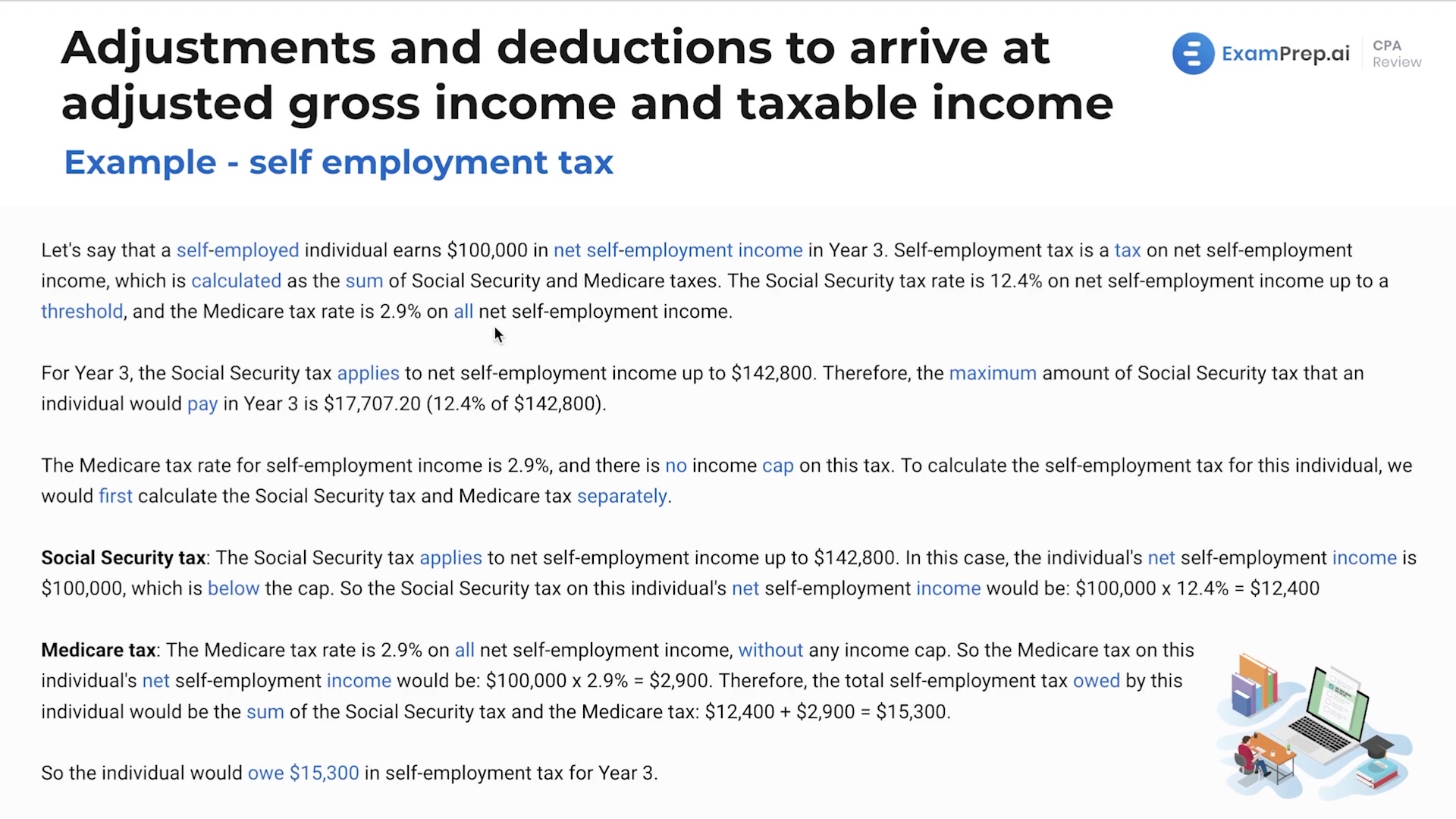

In this lesson, Nick Palazzolo, CPA, delves into retirement savings options for self-employed individuals, covering SEP IRAs, SIMPLE IRAs, and Solo 401(k)s, and the tax implications of each. He sheds light on the perks of lowering AGI through contributions to these accounts, ultimately leading to potential tax bracket reduction, increased eligibility for certain tax credits, and diminished exposure to taxes. Nick also breaks down the self-employment tax, diving into the specifics of social security and Medicare tax components, emphasizing the significance of self-employed individuals fulfilling both the employee and employer portions. To cap it off, he walks through the calculation of self-employment tax with a relatable example and touches on the benefits of above-the-line deductions like health insurance and half of the self-employment tax on their tax returns, ensuring clarity in how these elements can affect overall taxable income.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free