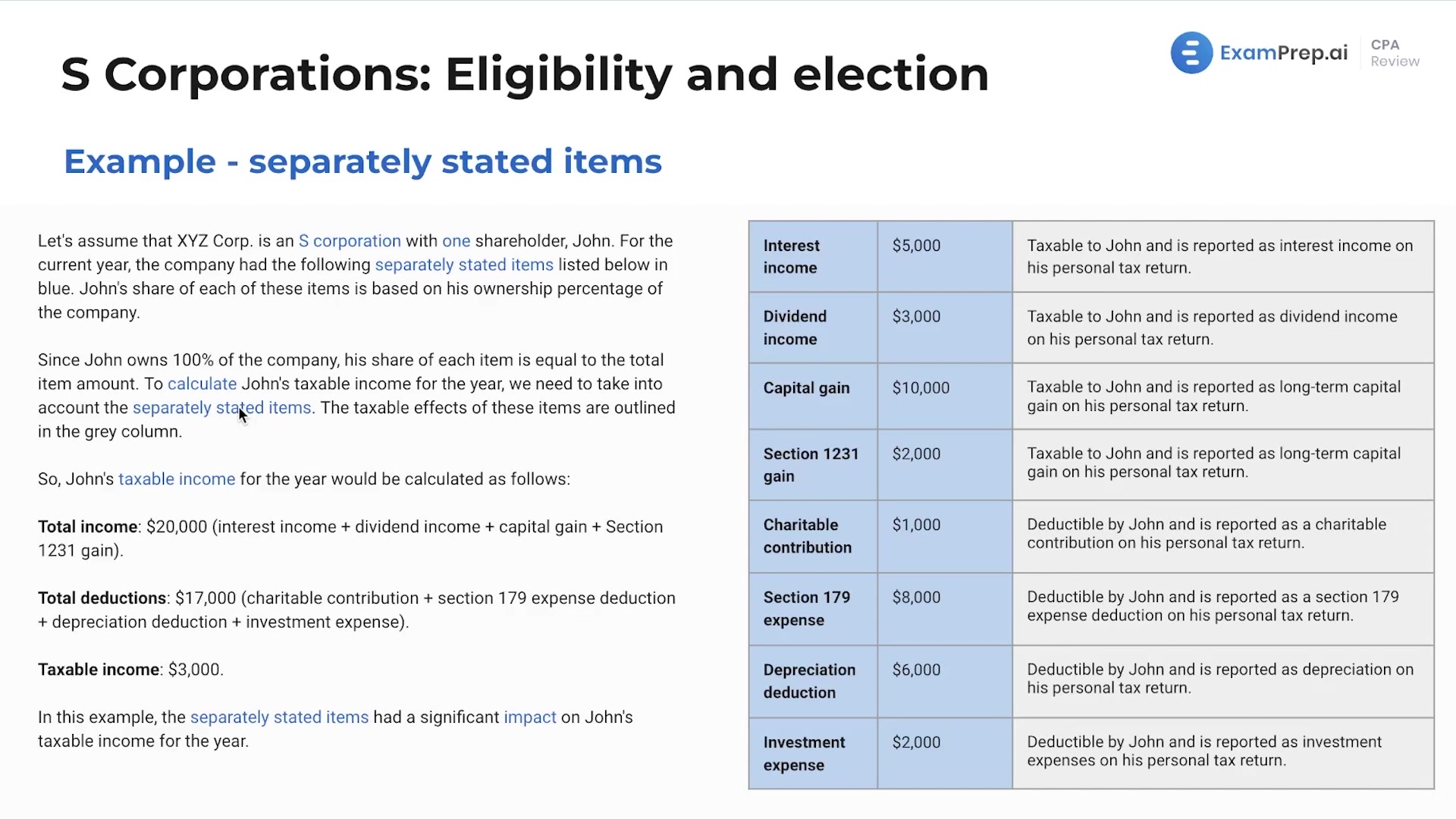

In this lesson, Nick Palazzolo, CPA, delves into the intricacies of separately stated items on S corporation tax returns, making this typically challenging topic crystal clear. He breaks down the difference between ordinary income and separately stated items such as interest income, dividend income, capital gains, and various deductions, demonstrating their critical role in a shareholder’s individual tax return. By walking through practical examples and emphasizing the importance of understanding and memorizing these items, Nick ensures that the concept is not only learned but mastered. The lesson includes analysis of tax forms and the treatment of these items on the 1040, helping to prepare for accurate and strategic tax reporting.

This video and the rest on this topic are available with any paid plan.

See Pricing